Equitable and Bestow launch digital insurance offering

Bestow and Equitable are announcing the launch of a new digital term life insurance offering called Term-in-10.

Powered by Bestow’s platform, Term-in-10 was designed for Equitable “from the ground up” and is only available through Equitable agents. Existing and prospective Equitable customers work with a financial professional to determine their specific life insurance needs and then apply for a term life insurance policy online. Term-in-10 doesn’t require a medical exam and is available in coverage amounts up to $1 million and in 10, 15 and 20-year term lengths. Coverage is issued by Equitable.

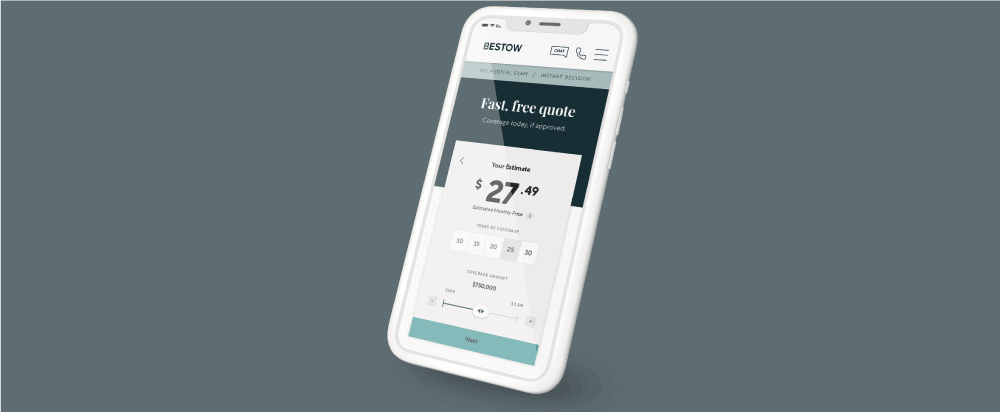

Bestow says that its enterprise offering delivers a single source application, underwriting, and policy servicing experience that supports the entire end-to-end sale and administration of term life insurance, with more products to come. Carriers can license Bestow’s platform to develop and launch digital solutions and Bestow also provides “the expertise and resources needed to launch digitally optimized life insurance products.”

“As one of the most respected life insurers in the industry, Equitable is the ideal first enterprise carrier partner for us at Bestow. We came together because of our joint commitment to build innovative solutions that expand access to financial protection. We’re excited to deliver our unique product expertise and platform to Equitable Advisors, Financial Professionals and customers.” – Melbourne O’Banion, co-founder and CEO of Bestow.

“Insurance is personal. There are substantial advantages to using a financial professional and life insurance agent who understands the specific requirements each client needs to protect their family and provide them with a comprehensive financial strategy. We’re excited about the relationship with Bestow as it allows us to provide a better more efficient experience for our current and prospective clients.” – Dave Karr, chairman of Equitable Advisors.

“The insurance space is facing unprecedented change and opportunity given tech-driven disruptions and rising consumer expectations coupled with cost and competitive pressures. We also recognize that the pandemic prompted interest in new protection solutions and the way Americans shop for these products as more folks shifted their attention to focusing on their holistic well-being over the past year. The partnership with Bestow is another important step in our strategy to help financial professionals serve the needs of their clients with innovative and tailored solutions designed with today’s consumer in mind.” – Hector Martinez, head of the life insurance business at Equitable.

Bottom Line: Equitable is Bestow’s first enterprise client .