Edelweiss Tokio Life & Mobikwik to Offer “Miniature Insurance”

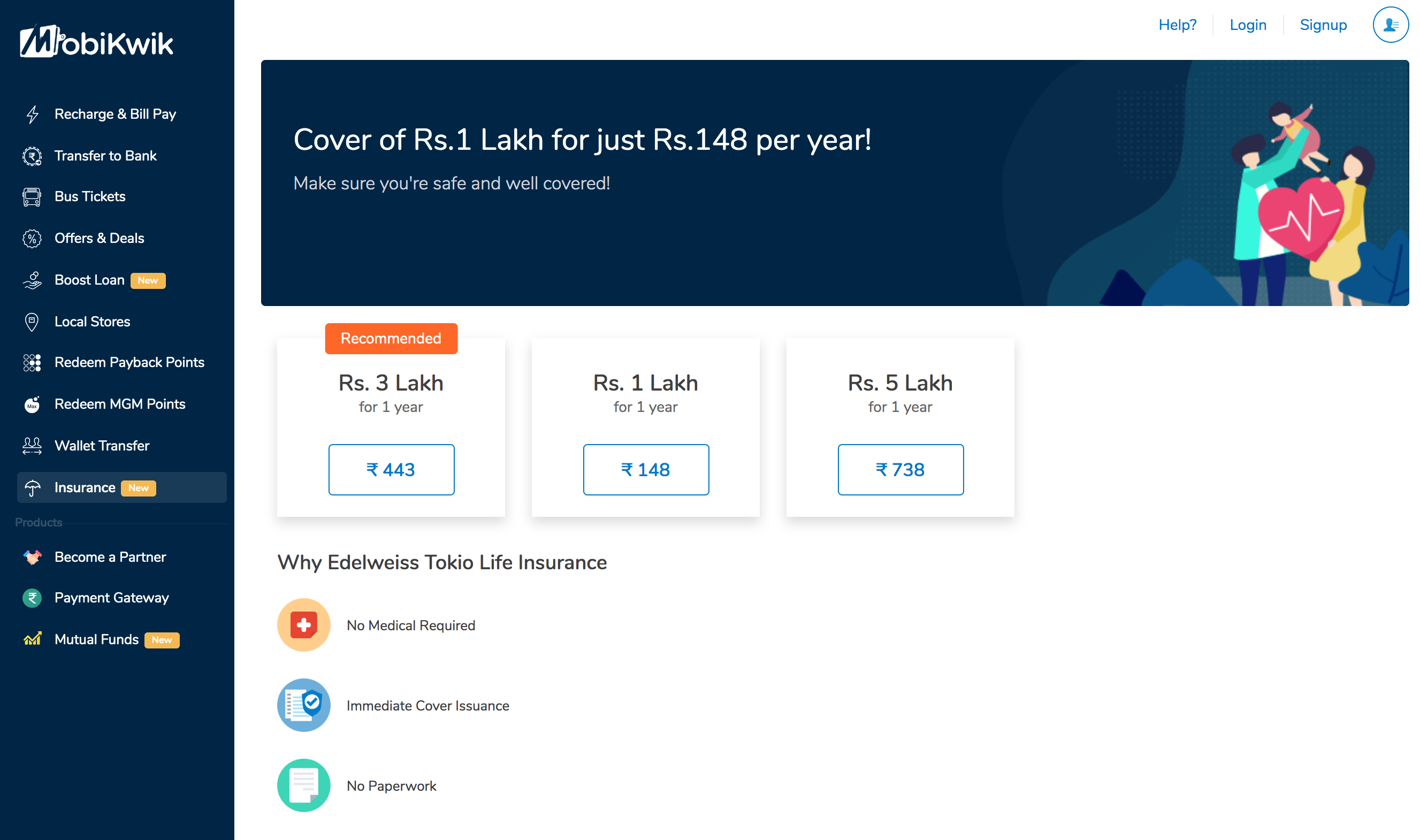

Private life insurer Edelweiss Tokio Life Insurance has partnered with payments platform Mobikwik to sell ‘miniature’ insurance plans for Rs 1 lakh, 3 lakh and 5 lakh with a premium of Rs 148, 443 and 738 per annum. This partnership will allow Edelweiss Tokio Life to cater to customers across all income groups.

“Riding on the MobiKwik app ecosystem KYC and other capabilities, we can issue and service the policy directly within in the app ecosystem, instead of the customer engaging with two separate entities.” – Sumit Rai, MD & CEO, Edelweiss Tokio Life Insurance.

The life insurer has already taken steps to go digital. Internally, in the last financial year, Rai said that the company completed a digital overhaul within Edelweiss Tokio Life called Project Transcend, to help in scalability and create a flexible platform to cater to increasing volumes smoothly.

“We are using data analytics in a big way to manage customer interaction more efficiently and take proactive steps in curbing risks, including fraudulent activities. Over the last year, we have been focused on creating pre-emptive processes that can flag off any fraudulent behavior,” he added.

Overall, while the ticket sizes in digital insurance are currently low, Rai said they expect them to increase over a period of time. In FY19, Edelweiss Tokio Life collected new business premium of Rs 455.63 crore, showing a year-on-year jump of 33 percent.

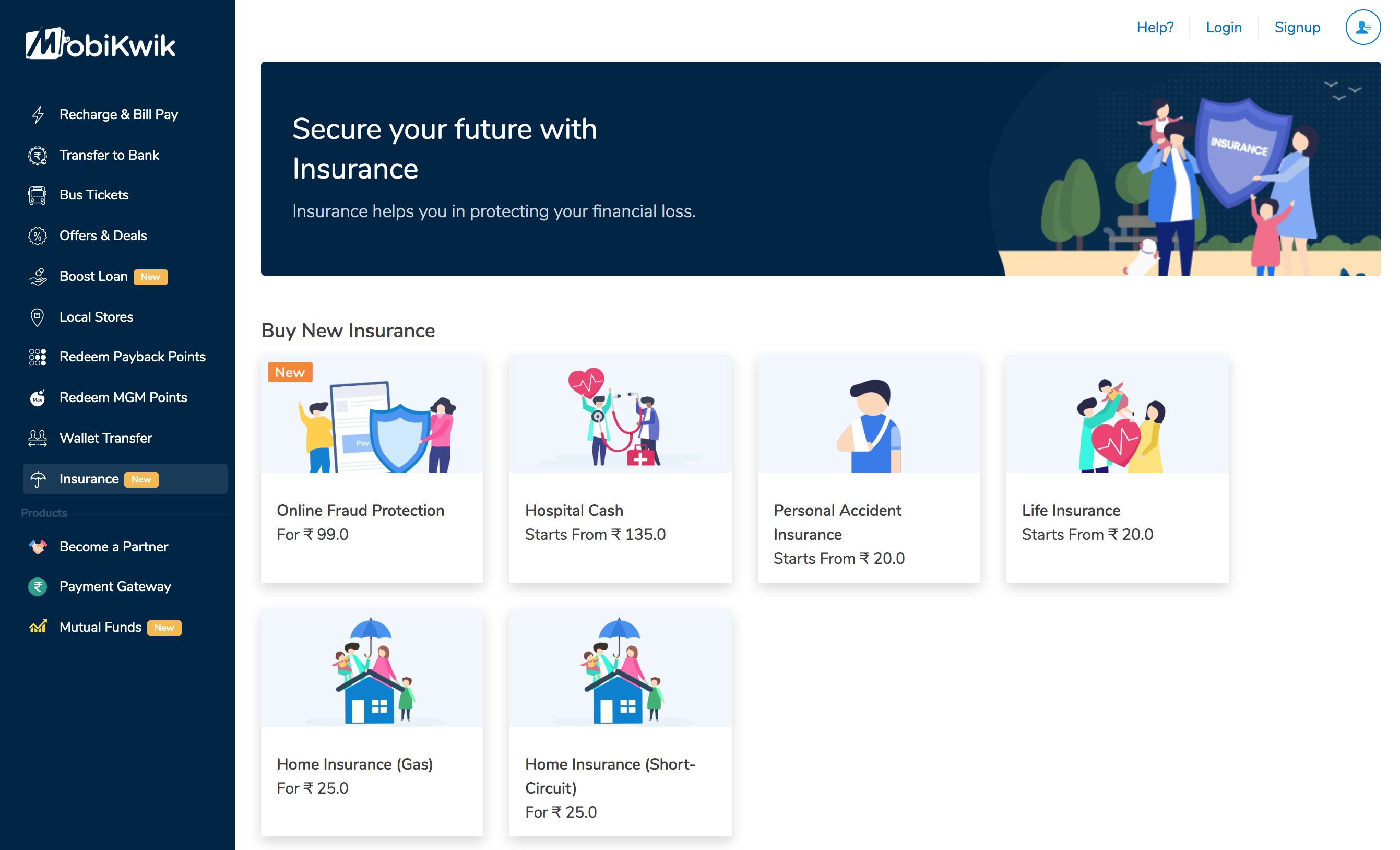

Last, MobiWkik also has a life insurance distribution partnership with ICICI Prudential and Aegon Life.  Bottom Line: Fintechs are the better insurance distributors.

Bottom Line: Fintechs are the better insurance distributors.