Dispatches from research: The tempered optimism of Gen Z and what it means for insurance

Like every generational cohort that has come before it, Gen Z is surfacing new anxieties, critiques, cliches, and questions about how they compare to other generations—as consumers, individuals, voters, employees, and so on. For this generation, cliches like “they don’t want to work,” “they are addicted to their phones,” “they are too coddled,” and “they all want to be influencers” are commonplace. To what degree any of this is true does not negate the fact that the Gen Z generation is now aging into full-fledged adulthood, with the oldest approaching 30. Gen Z, in other words, is our future.

When talking about Gen Z and the research we are doing that is currently afoot, it would be remiss not to acknowledge the growing scrutiny around generational framing. In fact, one of America’s oldest and most trusted research organizations has abandoned this framing altogether, citing its inability to produce meaningful comparisons and the tendency for inaccurate and often derisive cliches to emerge from this type of research.

Still, the fascination remains —people, specifically those we work with within the insurance industry, want to understand Gen Z.

So before making broad claims (we’ll get to that, don’t worry) about a generation that spans 85 million people whose only shared trait is being born within an arguably arbitrary 15-year window, we take a step back. We start by acknowledging the cultural forces that have shaped this generation, for better or worse, while also recognizing that how individuals experience and respond to these cultural forces varies widely.

As the great Jean Twenge has remarked, “The arbitrary nature of generational names and spans does not negate the reality that growing up during different eras can have a profound effect.”

To that end, there are a few things that most experts agree have and continue to shape the Gen Z generation:

- Deep political division and shifting societal norms

- The global upheaval of the Covid-19 pandemic

- The rapid emergence of generative AI and automation

- A redefinition of the value and accessibility of higher education

- The ever-present influence of social media and digital connectivity

Understanding these shifting mindsets isn’t just an intellectual exercise for industries like insurance; it’s a business imperative. How does a generation raised amid uncertainty think about financial security? What role does insurance play in their vision of stability? And how can an industry built on long-term commitments and institutional trust connect with a generation that questions both?

To start answering these questions, we surveyed 519 Gen Zers, born between 1997 and 2007, to better understand their financial attitudes, career outlooks, and perspectives on insurance. The following are derived from insights and data from this survey and a preliminary round of qualitative interviews.

Here’s what we’ve learned so far—followed by some initial thoughts on what it could mean for the future of insurance.

1. The old playbook for financial stability is due for a rewrite.

The oldest of the Gen Z generation were launching their careers when Covid hit in 2020 and consequently were the first to be laid off. And while Gen Z has made employment gains over the last 5 years, a recent survey published last fall found that 37 percent were worried about being laid off, compared with 27% of the general population.

Full-time jobs just aren’t enough.

Even for those who do have stable jobs, Gen Z, like other generations that came before it, are largely unsettled in their careers:

Our survey found that:

- Only 13% of Gen Z see their current job as a long-term career path.

- 33% actively plan to leave their current job, perhaps signaling a lack of confidence in long-term career growth.

Job anxiety and insecurity aren’t just about finding and keeping a job; our qualitative research has surfaced concerns about AI and other technology disrupting what once seemed like lucrative industries (i.e., tech), mass government layoffs, and worries that one job won’t be enough.

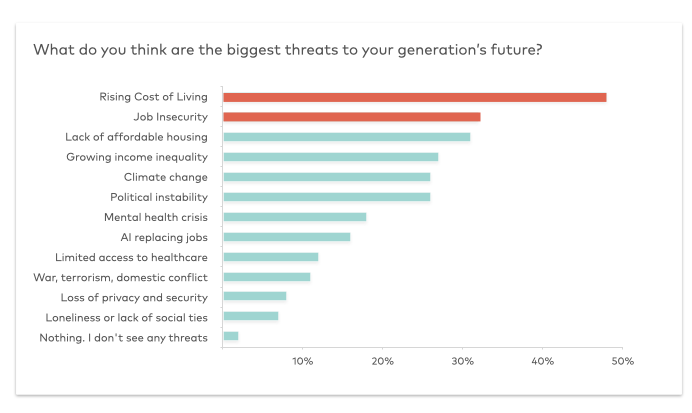

Gen Z sees the rising cost of living and job insecurity as the two biggest threats to their generation. These two anxieties are not unrelated. Not only are Gen Z worried about their job prospects now, but they also worry that in 10 years, their industry or field may no longer exist. Even if they can secure decent jobs in a field they want, there is a genuine concern that one job won’t be enough due to the rising cost of living.

As one survey respondent wrote, “The cost of living is impossible even with good jobs.”

The side hustle is now a necessity.

Perhaps most illustrative of this point is what our survey found regarding side hustles.

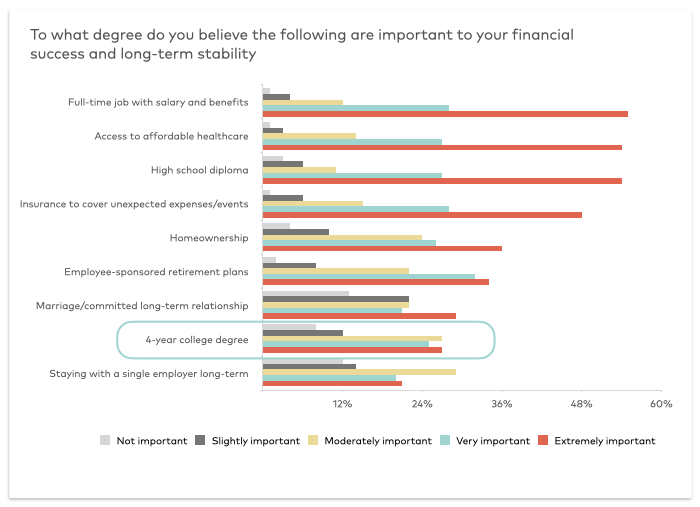

While 55% believe that a full-time job with benefits is extremely important to their financial stability and long-term success, nearly the same percentage — 50%— believe side hustles and multiple income streams are the best way to achieve economic security and success (compared with 34% who say traditional career progression and job promotion), highlighting skepticism toward relying on a single employer.

From what we can tell so far, Gen Z views side hustles in two ways:

On the one hand, they see multiple income streams as a bulwark against job instability. If this one way of making money dries up or becomes obsolete, there’s a backup plan.

Case in point: One young man we spoke with who is a freshman in college majoring in computer science is also pursuing his real estate license as a Plan B.

On the other hand, they see having a side hustle as a way to supplement a more traditional job and, for some, as the only way to get ahead financially.

“Young adults in my age bracket have to work multiple jobs with multiple side hustles just to survive in today’s economy,” wrote one survey respondent.

College degrees are no longer seen as essential.

Further signifying a shift in how Gen Z is thinking about the traditional paths to financial security, only 28% believe that a college degree is essential for economic success. Or, put another way, Gen Z see a college degree as less important to financial success and long-term stability than getting married or being in a long-term committed relationship.

Together, these data points paint a nuanced picture of a generation caught between the traditional path to financial stability they were primed to pursue and the stark economic realities they have experienced thus far—especially in the wake of the past five years of upheaval.

One research participant said it best:

“The traditional formula that most other generations have participated in—go to college, which I did; get a good job, which I did; work hard, save money, which I’m doing—aren’t necessarily the right steps anymore. You can work as hard as you can, and that still might not be enough to keep up with the increasing cost of living, increasing cost of housing, the availability of housing, etc.”

Jayne, Program Manager at a Rideshare Company, 25

2. Institutions are out. Individuals are in.

Declining faith in institutions among Americans has been widely reported and wielded as an explanation for everything from the election results, the anti-vax movement, fake news, and Crypto.

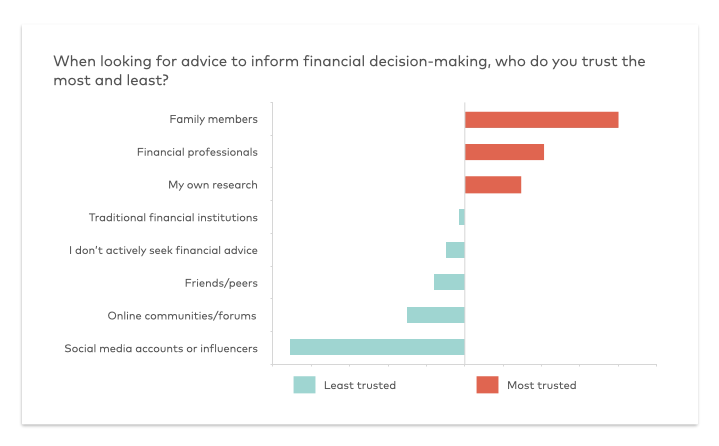

It shouldn’t be a surprise, then, that we identified this same institutional distrust among Gen Z. Our research found that traditional financial institutions rank among the least trusted sources of information for Gen Z seeking out financial advice.

Only 6% of those we surveyed consider banks and financial institutions their most trusted source of financial information and advice, fairing worse than social media, which, while by far the least trusted, was more likely than traditional financial institutions to be the most trusted.

In our qualitative research, which is ongoing, this same distrust in the insurance industry is pervasive and extends to the government as well.

“I don’t trust anything coming from the government.” – Survey Respondent

Conversely, trust in individuals, including financial advisors and professionals, remains high. Regarding advice informing financial decision-making, 34%—the highest percentage among the options listed—trust family members and personal networks the most, followed by financial professionals at 22% (i.e., advisors, brokers, and agents).

So much depends upon “the good people” who work in insurance.

In fact, for many Gen Z we spoke with, the good people working in insurance, helping customers navigate what many see as a broken system, were the only saving grace for the industry.

“The one reason we won’t leave State Farm is because the person in charge of our branch is very ethical and uses her ethics to navigate what I perceive to be a very problematic business.”

Zoe, PhD Candidate in Computer Science and Engineering, 24

Still, this faith in people isn’t translating into trust in insurance companies or the insurance industry itself. When we asked Zoe, the research participant quoted above who won’t leave State Farm because of her agent, what would make a job in insurance more appealing to her, she said:

“Just knowing the company has ethics I can stand behind instead of knowing they’d be relying on my ethics to navigate their unethical business.”

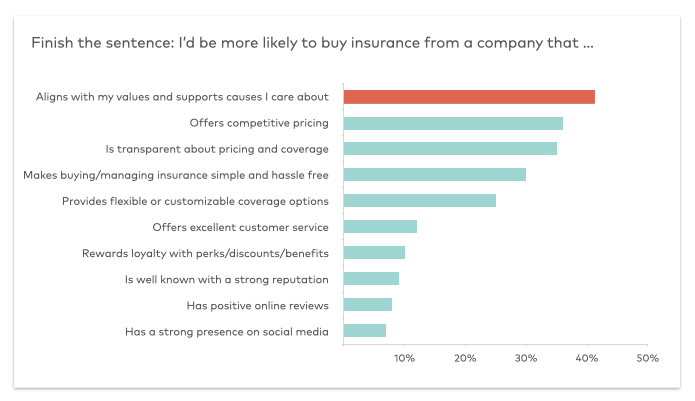

This sentiment was also borne out in our survey, with 43% of Gen Z citing value alignment as the number one thing that would make them more likely to buy insurance from a specific carrier — more important than price when selecting an insurer.

3. The rules are changing, but financial optimism is still in play.

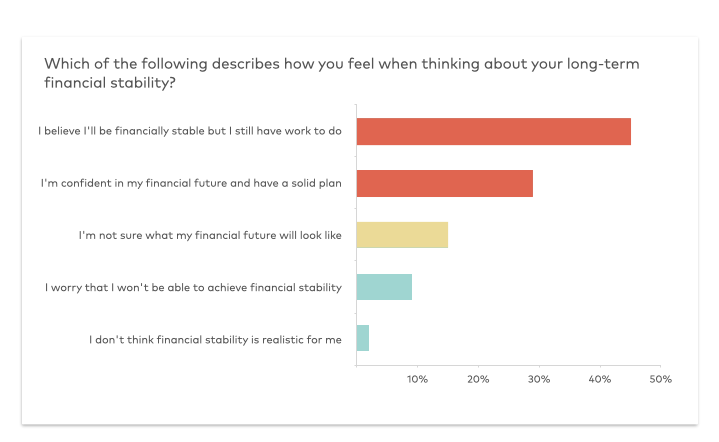

Despite the challenges they face in the present and uncertainty about the shifting target, which is their future, the Gen Z population we surveyed was generally optimistic. While the path forward is far from laid out for them, this generation, which has already learned to adapt to so much, is laying its own path to financial stability—and many are optimistic that the struggles they face today will pay off in the future.

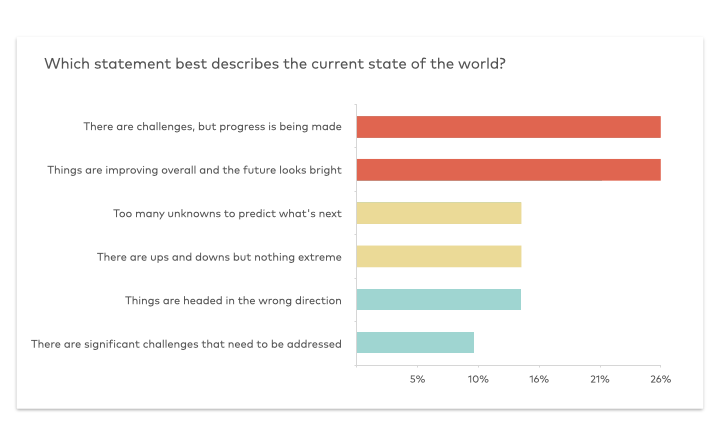

47% have a generally positive attitude about the current state of the world, with 26% recognizing that there are challenges but progress is being made and 21% believing that things are improving overall. This compared to the 38% who saw things more negatively and the 14% who were somewhere in between.

Confidence in one’s ability to navigate uncertainty is strong.

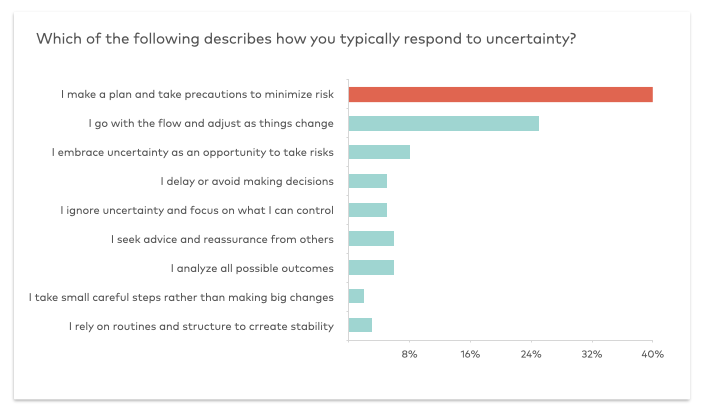

More striking, however, were the 74% who felt confident in their ability to adjust and plan for the future despite their financial concerns and uncertainties.

To this end, the Gen Z population we have surveyed and spoken with demonstrate wisdom beyond their years. While not always experienced, they are financially astute—saving for the future, making contingency plans, and living within their means—willing to work second or third jobs to save money if they need to.

As one young woman we interviewed stated, “I think what makes our generation different from Millennials is that we are willing to struggle for what we want.”

In this sense, they are ideal insurance customers, understanding that there are no sure bets and looking for ways to hedge their risks. Possessed with self-confidence and resilience forged by the fires of economic uncertainty, rapid technological change, and the upheaval of a global pandemic, Gen Z has become adaptable, quick to pivot, and uniquely prepared to navigate their unpredictable future.

So, what does this mean for insurance?

Gen Z is coming of age in a world of economic uncertainty, institutional distrust, and shifting career norms, yet they remain adaptable and optimistic about their ability to shape their own futures. They aren’t waiting for traditional institutions to guide them—they’re actively seeking financial security on their own terms.

For insurance, this presents both a challenge and an opportunity: to earn Gen Z’s trust, insurers must move beyond transactions and demonstrate real value—empowering them with knowledge, adaptable solutions, and experiences that meet them where they are.

1. Empower Gen Z with financial literacy and self-reliance. This generation isn’t waiting for institutions to guide them—they’re actively seeking knowledge to build economic resilience. Insurers must find ways to go beyond selling policies and create digital experiences that educate, equip, and empower Gen Z to make informed decisions about risk and security on their own terms.

2. Be thoughtful with AI—make it a tool for empowerment, not control. AI can streamline processes, but Gen Z is wary of technology that threatens their autonomy. Instead of using AI to automate away human interactions, insurers should focus on AI-driven tools that provide personalized insights, financial guidance, and risk management strategies—giving Gen Z more agency over their financial future.

3. Design for financial fluidity. Gen Z doesn’t see financial stability as a linear path. Insurance products and digital experiences must reflect this by offering flexibility—coverage that adapts to changing jobs, side hustles, and unpredictable income streams.

4. Build trust through transparency and positive interactions. Gen Z is deeply skeptical of financial institutions but trusts individuals—agents, advisors, and brokers who provide real value. Digital experiences should elevate human interactions, not replace them, prioritizing ethical, customer-first design.

5. Values alignment matters more than ever. Gen Z chooses brands that align with their ethics; insurance is no exception. Companies must demonstrate—not just claim—integrity, fairness, and a commitment to putting customers first. Seamless, transparent, and ethical digital experiences is a first step in helping build long-term loyalty.