Delos announces partnership with Canopius US

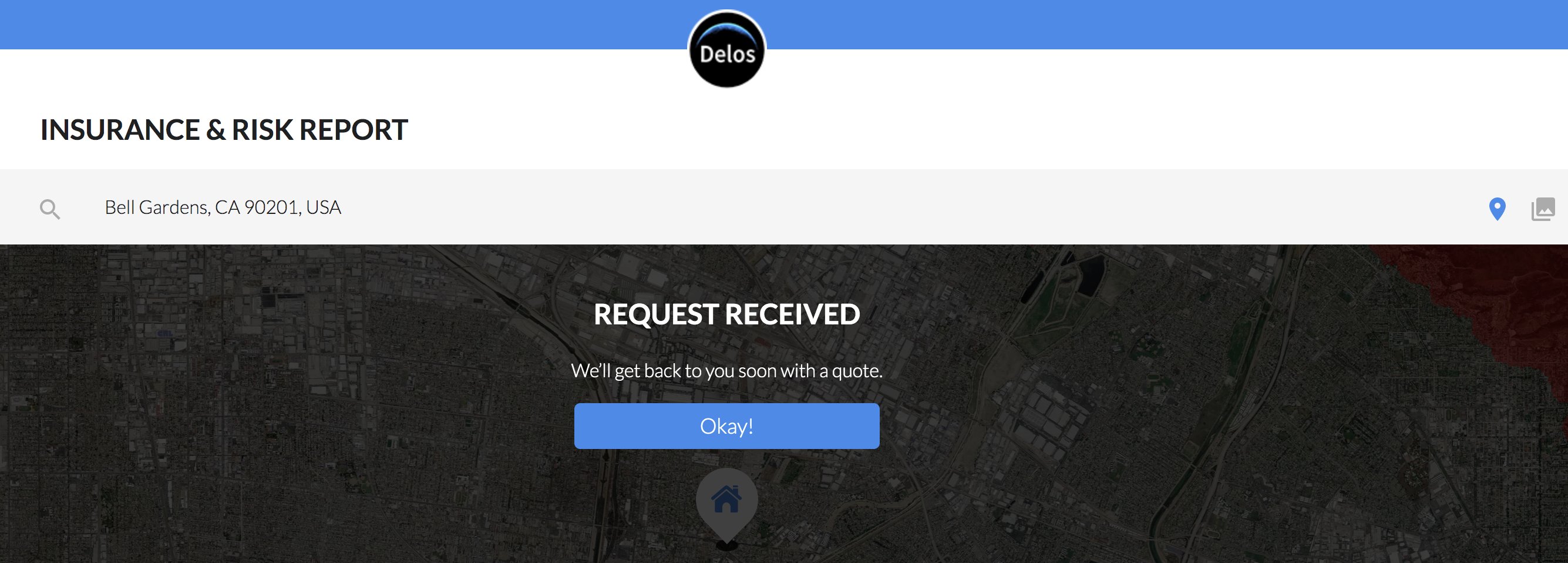

Property MGA Delos Insurance Solutions has partnered with Canopius US Insurance to offer insurance to low-risk homes within wildfire regions. Delos has created its own proprietary wildfire risk modeling that allows them to get a better understanding of the risks associated with properties in wildfire regions. This allows Delos to underwrite and price insurance for homes to an accuracy not previously available; ultimately, showing that many homes that are considered high risk by other insurers actually have low exposure to wildfire.

This same technology also enables Delos to provide Risk Mitigation Services to each policyholder – every homeowner receives on-going notifications of how their risk is changing and the most effective ways to harden their home to wildfire.

The partnership with Canopius intends to use the Delos technology to write policies on these homes, easing the hardship of the homeowners while simultaneously allowing the insurance and reinsurance communities to participate in wildfire-exposure through peril-specific experts.

“Our high-performing wildfire models allow us to achieve our goal—protecting homes by providing desperately needed affordable coverage and working with consumers to help them mitigate their risk. The number of catastrophic events has tripled in the United States in the last 30 years. Now is the time for the insurance market to shift from guesswork to relying on scientifically-driven catastrophe experts to underwrite perils. By focusing on the data, we can reduce the insurance gap and give homeowners peace of mind.” – Kevin Stein, co-founder and CEO, Delos Insurance Solutions .

The initial launch of the partnership’s product will offer coverage in the state of California, later expanding to other US states.