Bondaval raises $15 million

Bondaval , the London-based B2B insurance startup offering a solution to secure credit risk, has closed a $15 million Series A Round led by Talis Capital, with participation from Octopus Ventures, Insurtech Gateway, TrueSight, Expa, FJ Labs, and Broadhaven Ventures.

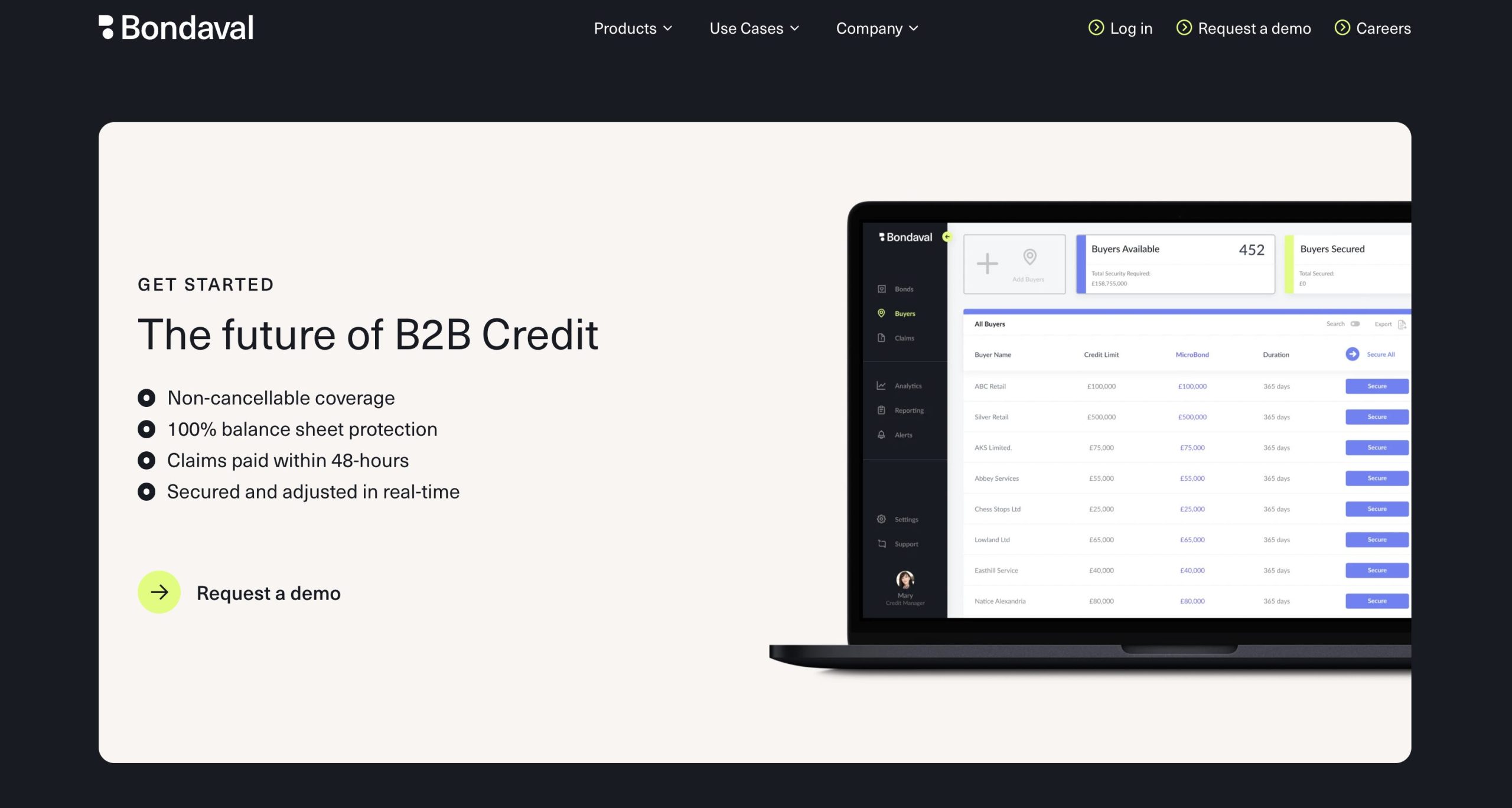

Founded in 2020, Bondaval combines credit analysis technology with S&P A+ rated insurance backing to create a more secure, capital-efficient and cost-effective form of receivables protection that can be issued, renewed and claimed digitally.

The company’s key offering is its MicroBonds, technology-enabled surety bonds that secure receivables and can be easily purchased, and managed, through the Bondaval platform. Created for credit managers in large commodities companies, MicroBonds are non-cancellable digital financial instruments that provide 100% indemnity, have no collateral requirement and can be used alongside existing security.

Bondaval has offices in both London and Austin, Texas.

“When we first established the business less than 2 years ago, we could only imagine how quickly the market would respond to our technology-led approach for payment security. We are honoured by the confidence shown by our existing investors and our new investors and the validation from our best in class clients. We look forward to increasing access to more favourable financial security for all parties involved in B2B credit transactions and demonstrating more applications for our MicroBonds.” – Tom Powell, co-founder and CEO of Bondaval.

“What the Bondaval team has been able to achieve in its first couple of years is truly remarkable. We rarely see this pace and thoughtfulness of execution, which is a testament to the talented team that Tom and Sam are assembling, combined with exceptional demand for this product. The simple elegance of MicroBonds unlocks several transformational use-cases, which have the potential to fundamentally alter credit markets. We see limitless potential for Bondaval and are delighted to partner with this world-class team.” – Thomas Williams, general partner at Talis Capital.