Belfius to discontinue Jane

Belfius , the Belgian state-owned bank and insurance company, is discontinuing its smart home solution for the elderly.

The message displayed on the website of Jane is as follows: “Unfortunately JANE will stop its activities on the 22nd of December 2023! Questions? Please contact us via support@jane.be.”

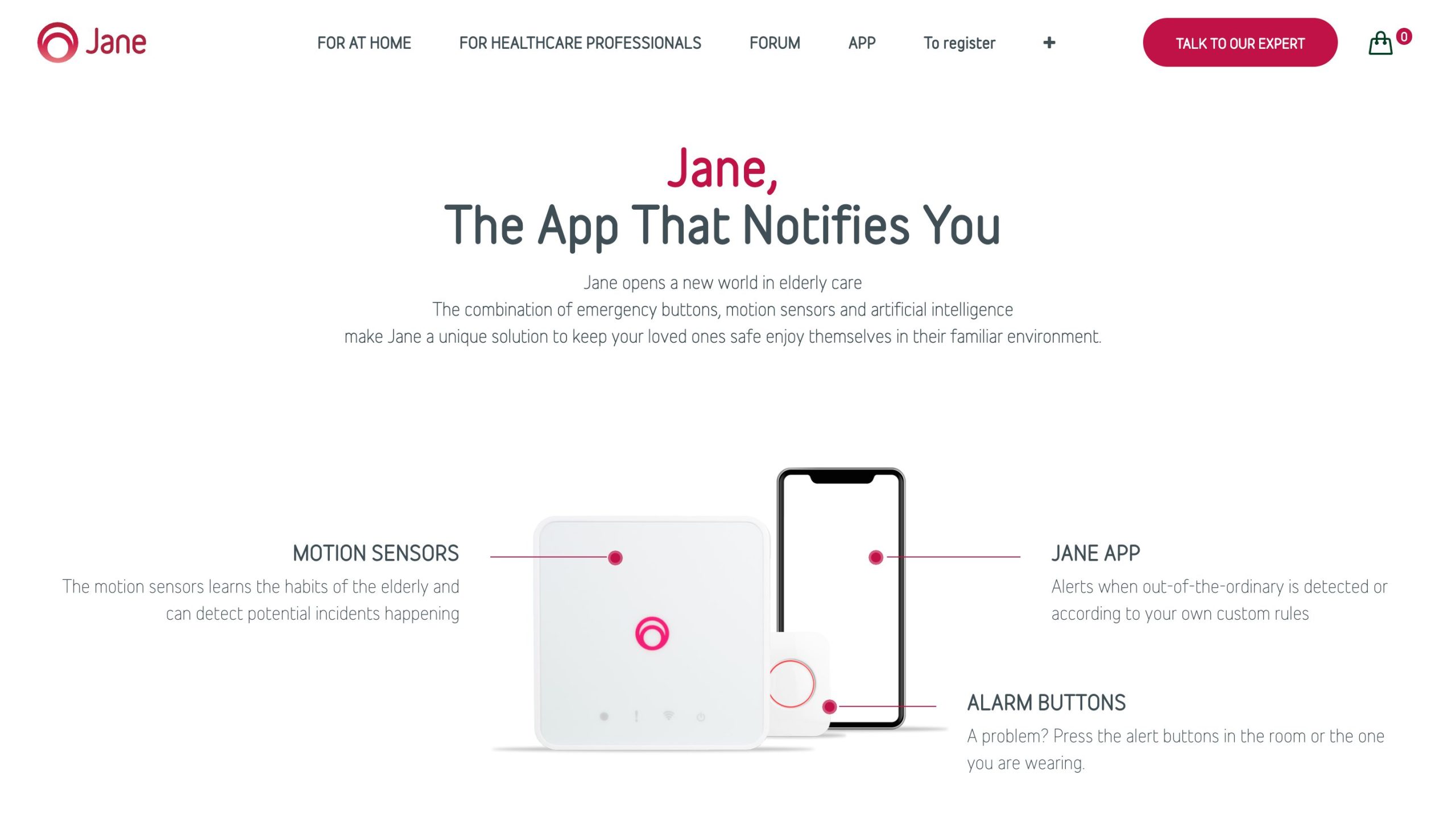

Jane, initially named Charlin, was founded in 2018 and became operational towards the end of 2019. It offered a monitoring solution for the elderly, equipped with sensors that alert caregivers of any unusual activities. In 2021, Jane’s system was credited with saving the lives of seven individuals. Additionally, in the same year, Belfius Insurance invested an extra €3 million in Jane, elevating its ownership share to 92.67%, up from 77.4%. Boston Consulting Group holds the remaining equity in the company.

Jane, initially named Charlin, was founded in 2018 and became operational towards the end of 2019. It offered a monitoring solution for the elderly, equipped with sensors that alert caregivers of any unusual activities. In 2021, Jane’s system was credited with saving the lives of seven individuals. Additionally, in the same year, Belfius Insurance invested an extra €3 million in Jane, elevating its ownership share to 92.67%, up from 77.4%. Boston Consulting Group holds the remaining equity in the company.

Similar to Belfius, State Farm also had a now-discontinued project targeting older adults. In 2020, Sundial Labs introduced Sundial, a mobile app and Alexa skill designed to help seniors stay connected with their family and friends from home. Initially, the service was priced at $19.99 per month. Later, a promotional offer reduced the fee to $14.99 per month for the first six months for those who signed up by December 31, 2020, followed by a rate of $11.99 per month with a six-month commitment. Early users also received a complimentary Amazon Echo Show 5, subject to availability.

However, in July 2021, State Farm suspended the Sundial service. The company stated they were pausing new sign-ups to implement significant updates and to potentially reintroduce Sundial at a lower price, focusing on better understanding and meeting customer needs.

Subsequently, State Farm completely withdrew Sundial from the market. Later developments, particularly a lawsuit filed on November 3, 2022, revealed that State Farm was accusing Amazon of copying elements of its Sundial senior healthcare technology.

In summary, between AG Insurance’s suspended Phil at Home service, Jane, and Sundial, it’s evident that developing subscription-based services for seniors has encountered multiple challenges and setbacks.

Despite facing challenges, some insurance companies successfully expand their services beyond traditional insurance, as exemplified by Brotherhood Mutual.

Brotherhood Mutual, serving approximately 68,000 churches across the nation, initiated MinistryWorks in 2010. This platform offers tailored payroll and tax filing services for churches, reflecting the company’s mission of “Advancing the Kingdom by Serving the Church®.” Abel Travis, Senior Vice President of Affiliate Operations at Brotherhood Mutual, acknowledges this initiative as a significant achievement.

Currently, MinistryWorks supports nearly 7,000 clients, to expand its reach to 20,000 by 2030. Initially focusing on payroll services, which is relevant for small churches with limited payroll requirements, the venture is now diversifying. It plans to extend its offerings to include retirement plans, life and health insurance products, and administrative services. MinistryWorks has proven to be profitable, typically managing payroll for about seven individuals per client but can scale its offering to much larger ministries.

A standout feature of the platform is its impressive 99% client retention rate. This high level of client loyalty not only speaks to the effectiveness of MinistryWorks but also contributes to enhancing the retention rate of the company’s property and casualty (P&C) insurance to 95%.

Bottom Line: Coverager Research members can view the list of active and inactive initiatives that move beyond protection here.