Beazley Personalizes Your Insurance Policy

Specialist insurer Beazley has launched a digital insurance policy for its Beazley Weather Guard product that, “for the first time ever,” describes in plain English precisely what coverage the policyholder has bought.

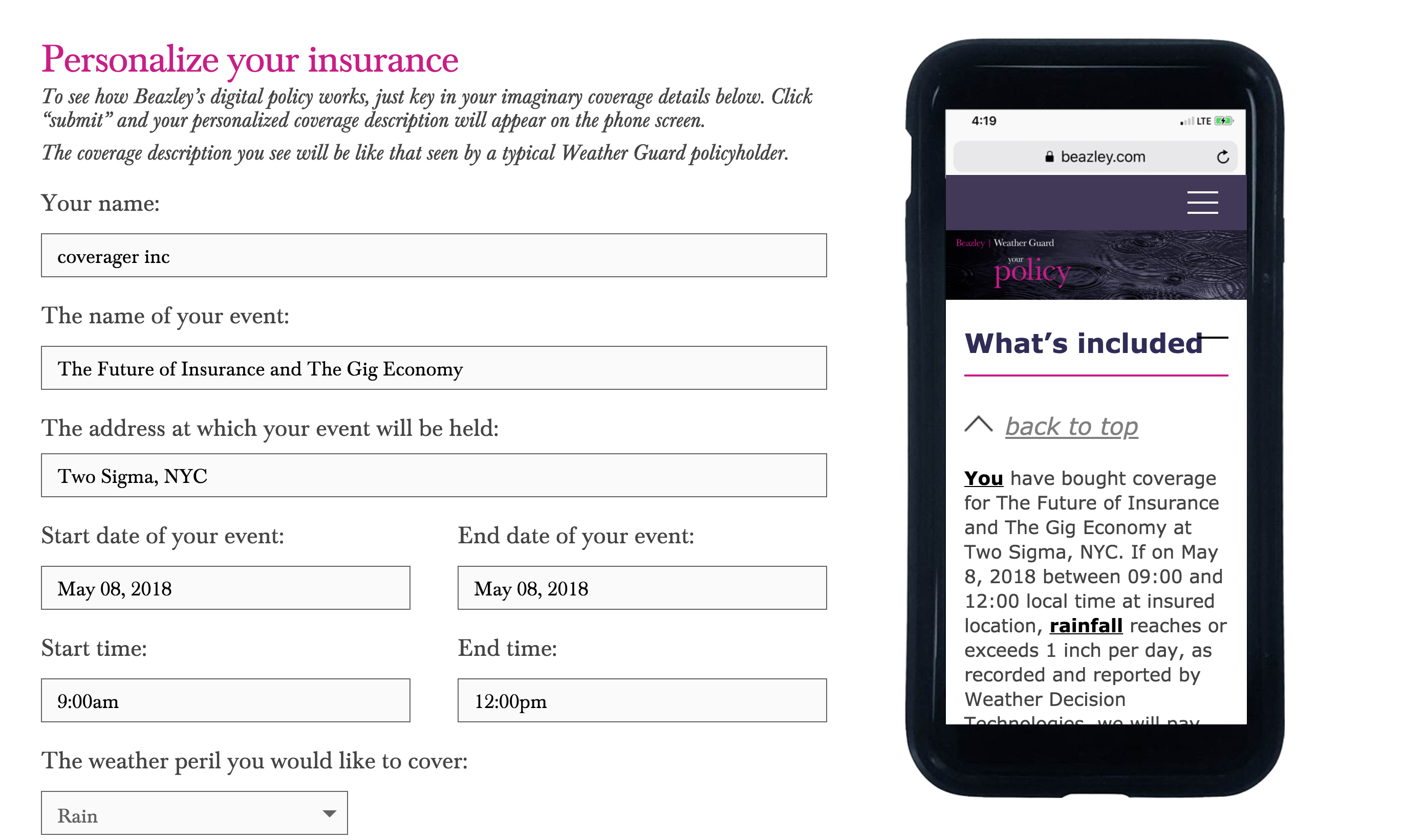

Personalize here.

The language of the new digital policy, which can be easily accessed on a mobile device, describes precisely (and exclusively) the coverage purchased. The first sentence of each policy spells out the trigger for coverage, together with the sum insured in dollars (or other applicable currency) and any self-insured deductible.

“We wanted to give event organizers a simple but precise description of their coverage that they could access at a glance on a mobile phone. If you’ve bought a Beazley Weather Guard policy to protect your event against heavy snow, your digital policy will specify ‘snow’ and explain how many inches of snow will trigger coverage. If the covered peril is excessive heat or cold, your policy will explain how high or low the temperature needs to be to trigger coverage. It’s entirely personalized” – Beazley contingency underwriter, Christian Phillips.

Until now, all insurance policies have been paper or pdf documents comprising two main parts: an initial ‘declarations’ page summarizing the coverage purchased and a much longer, standard policy wording that shows all possible forms of available coverage, including coverage not purchased. Beazley has integrated the two parts of the Weather Guard policy into a personalized digital (HTML) document that is far shorter and easier to understand.

“Insurers have generally struggled with plain English policy wordings. Traditional policies are one-size-fits-all documents that describe every possible form of coverage the policyholder might have bought. To remind yourself of what you actually have bought, you have to constantly flick back to the declarations page” – Beazley’s chief marketing officer, William Pitt.

“We asked ourselves: What would happen if all the information on the declarations page was instead integrated into the policy wording itself? When we did this, we found that it made the policy much easier to understand. Instead of ‘named insured,’ we could insert the actual name of the policyholder. Instead of ‘sum insured,’ we could insert a dollar amount. It all became much less abstract.”

Beazley‘s digital Weather Guard policy has two other major advantages over paper-based insurance policies:

- Paper-based policies have, often lengthy, sections containing all the definitions used in the policy. In order to understand the coverage, the policyholder must constantly consult the alphabetical list of definitions. This chore is eliminated in the digital Weather Guard policy: any definition can be viewed by clicking on the defined term.

- Changes made mid-term to paper-based policies are recorded in endorsements that are appended to the policy. In the digital policy, the change can be incorporated immediately into the policy wording, ensuring that the coverage described in the wording is always up to date.

The digital Weather Guard policy is one instance of Beazley’s commitment to beautifully designed insurance , reflected in clear policyholder communications that eliminate redundant and obscure language. Beazley is exploring the potential value of digitizing other small business policy wordings.