Auctus Wants to Be The First to Bring Blockchain to Pension Funds

At this point, more like a project than a startup that’s created with the mission of improving the pension market by increasing transparency and eliminating common problems such as corporate governance issues, corruption, fraud, bribery, and bureaucracy, as well as lowering operational costs.

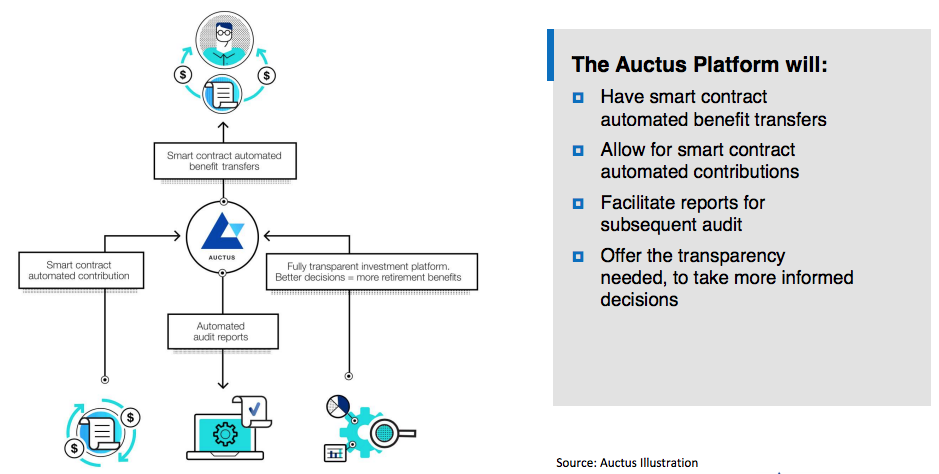

The idea is to apply blockchain to create a pension fund platform that will (1) ensure transparency, (2) make sure fund rules are met, (3) allow for a cost efficient audit, (4) provide data and calculations for contributions, employer match and benefits, and (5) enable selection of investment profiles, registration of beneficiary designations (in case of death), administration fee calculations and portability between funds.

“My partners and I live in a third world country. For years we’ve been ruled by a government that is well known to be corrupt and exploitation is underneath every institution, private companies and everything we do. It is in our state spending, in our transportation agencies, in company investment contracts and in everyday life when paying taxes”. “Take for example pension fund management: despite being heavily regulated, there are still numerous cases of fraud in pension funds around the globe be it in the UK or Brazil” – explained Auctus CMO Ludmila Lopes, who introduced the reasoning behind, and the concept of Auctus on Medium back in July.

Bottom Line: the company has recently boosted its advisory board with the hires of Eric Paley and Adam Greetis. Also it will hold an ICO that is set to start on November 14.