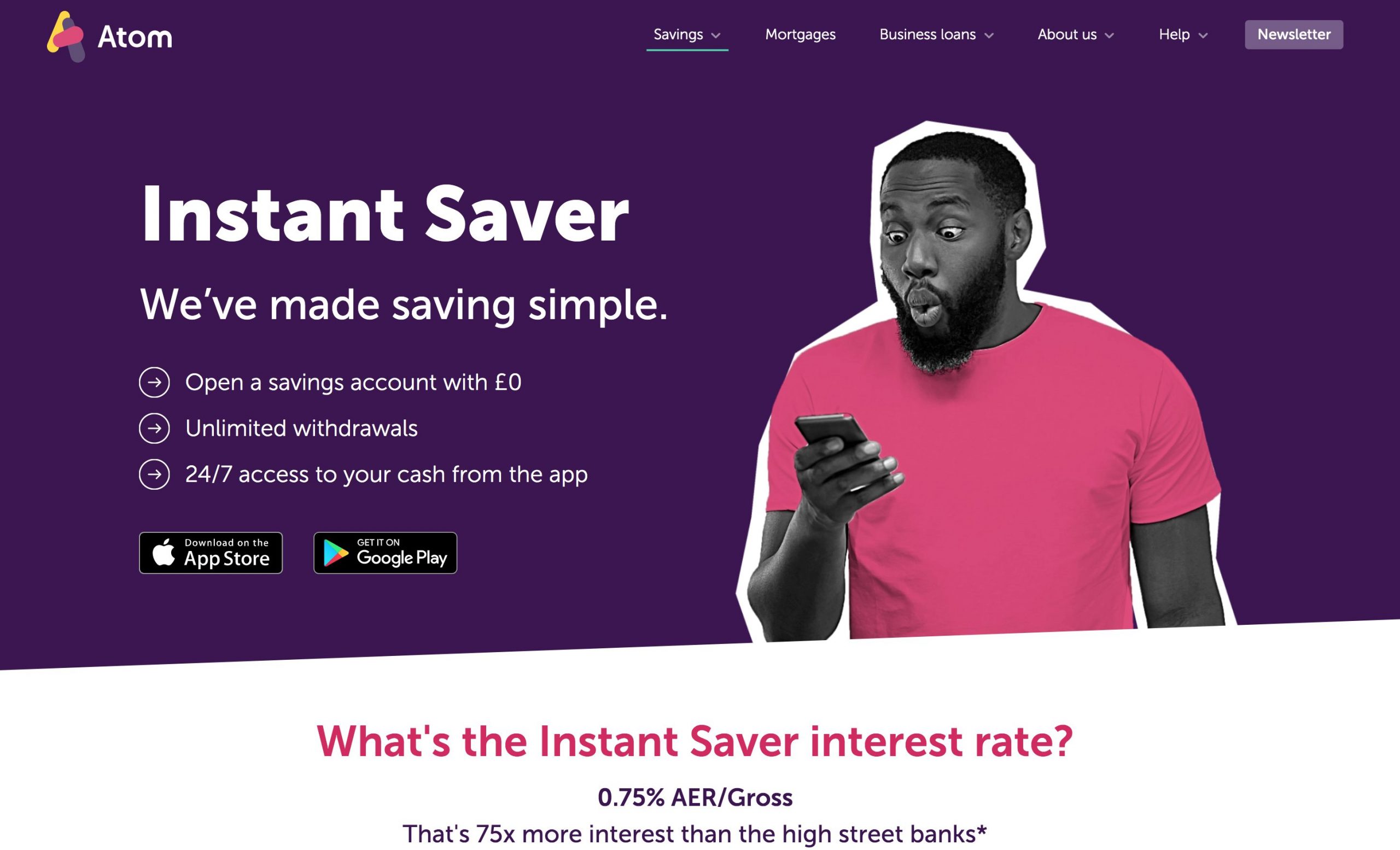

Atom bank launches Instant Saver

UK-based mobile bank Atom Bank has launched Instant Saver, with a highly competitive interest rate of 0.75% AER (variable rate), that’s 75x more than the high street banks. This is the first product to be launched on the startup’s cloud-native banking platform. Customers can make deposits and withdrawals without penalty, 24 hours a day, seven days a week on savings from 1p up to as much as £100,000.

Founded in 2014, Atom is a team of over 340 people. It has raised $584 million across 8 financing rounds (investors include Spanish banking giant BBVA and Woodford) and operates in the space of mobile banking, mortgages, and business loans. Last year it reached 65,000 customers, according to Statista.

“We’re here to do the right thing by our customers and the launch of our Instant Saver offers customers genuine value, empowering them to take control of their finances. With shockingly poor interest rates, the UK’s biggest banks are taking advantage of their customers with 0.01% interest on equivalent products. We think their money should be working a whole lot harder for them. With no short term bonus rate to lure you in, no limits on withdrawals and no minimum amount required, our Instant Saver can be accessed from the comfort of your own home and our app means your savings are with you 24/7, whenever you need them. We’ve built a bank that’s super-efficient, has award-winning customer experience and support and is determined to push the market in the favour of customers. This launch is an important next step. Built on our world-leading technology stack with Thought Machine and Google and signaling our continued growth, be assured we aren’t resting here.” – CEO and co-founder of Atom, Mark Mullen.