Asteya is looking to raise new capital

Based on information obtained by Coverager, disability insurance company Asteya is looking to raise $30 million as part of a Series B round.

Asteya was introduced to the world in March 2021, when the “startup” announced its public launch and a $10 million funding round. In a press release and a TechCrunch article, Asteya was portrayed as a new startup led by Alexandra Williamson, the former chief brand officer of popular dating site Bumble. However, Williamson is no longer with Asteya, which really isn’t a startup.

In a podcast, Williamson says that she joined Asteya at a point when the business was in the works for two years, starting off as an insurtech initiative by an existing insurance company. This leads us to IDU, Inc (International Disability Underwriters), Asteya’s “underwriting partner.” According to the pitch deck, Ed Kenney, the president and CEO of IDU since 2018, is listed as Asteya’s chief insurance officer, and Matthew Zuba, the current COO and CUO of IDU, is listed as Asteya’s chief underwriting officer. Based on company formation data, IDU and Asteya have a similar registered address (1111 Brickell Avenue, Suite 2600) and the same directors/officers – Robert Forti and Joseph Khoury.

Based on our sources, Asteya Holding Corporation is the parent of IDU, a provider of disability insurance products which in 2019 claimed to be the only MGU with access to domestic, international, and excess paper. IDU was incorporated in 2017 but its roots are older – it was built by Risk Insurance and Reinsurance Solutions, a company that got its start by offering disability insurance solutions for specialty, impaired and non-standard cases. Risk Insurance and Reinsurance Solutions has been in business since the 80s.

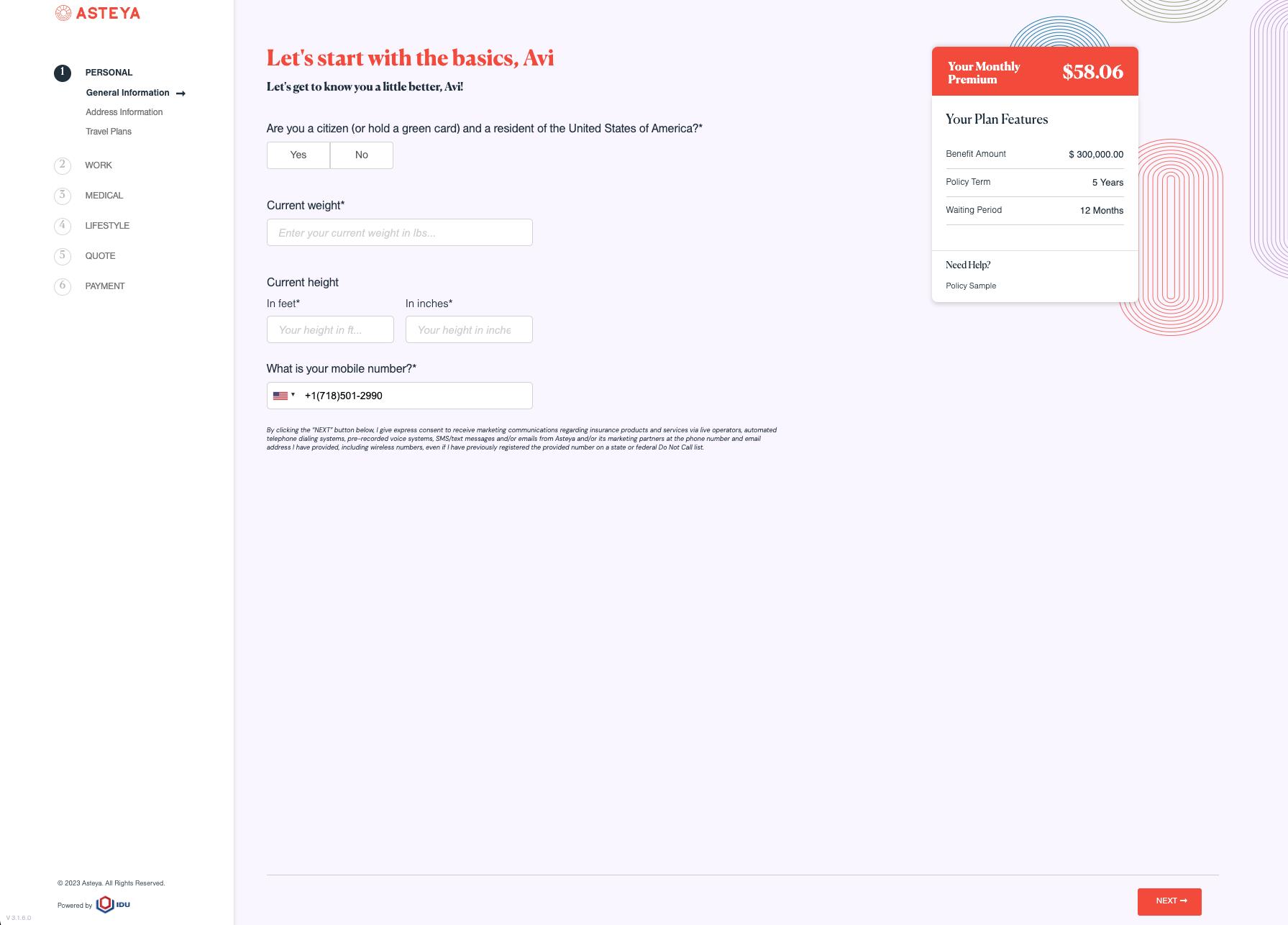

Asteya was developed by IDU as a D2C venture to democratize access to disability insurance. However, today it mainly sells through agents and the majority of the group revenue originates from IDU. It seems that IDU is also powering Asteya’s digital platform.

Based on information from the pitch deck, Asteya expects to end the year with $32 million in premiums and it has $3.7 million left in the bank, giving the company an 8-month runway.

Asteya is also working on an enterprise offering – a no-code SaaS platform that allows “non-technical users to create any insurance use cases, including creating a full operating insurance system from scratch.”