Aon partners with Nayms and Relm to launch cryptocurrency pilot

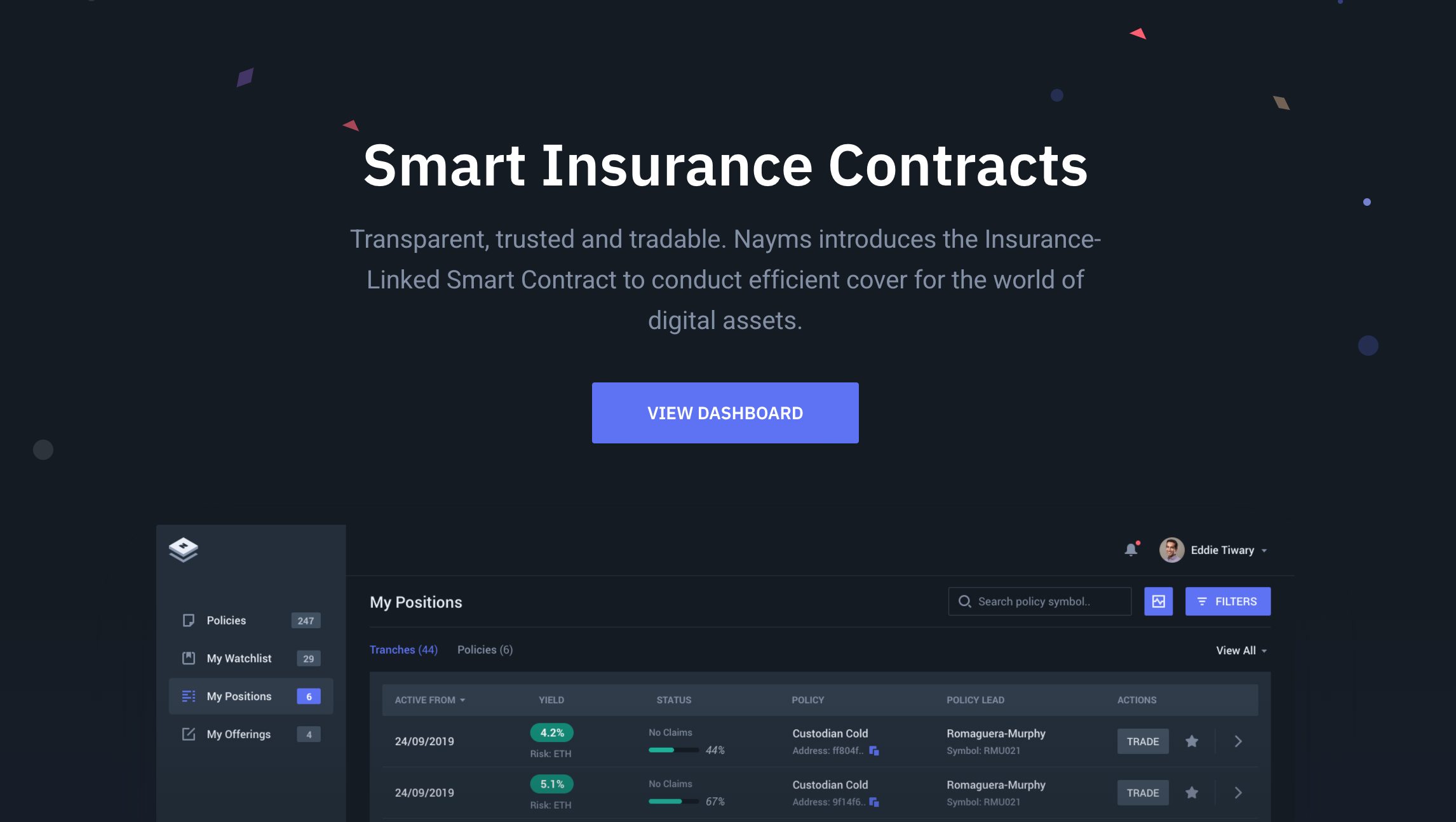

London-based provider of risk, retirement and health solutions Aon has partnered with crypocurrency insurtech firm Nayms and Bermudian specialist insurer Relm Insurance to launch a new blockchain-enabled crypto pilot.

As part of the collaboration, Aon via Nayms will conduct a first pilot with Teller Finance, a decentralized lending protocol, to highlight the ability to scale cover efficiently by matching assets to liabilities when underwriting crypto-specific risk. The underwriter for the contract will be Relm. The pilot will mark the first tokenized, or blockchain-enabled, placement of insurance ever conducted with regulated, professional insurance entities.

“Aon is committed to embracing technology and is constantly developing its offering for our growing client base in the digital asset space. By collaborating with Nayms and Relm to launch this pilot, we are taking the first step to creating a platform for digital asset companies to scale up their cover efficiently and cost effectively as the market continues to expand. As the first of its kind, this pilot represents a huge milestone for the digital asset and insurance industry. We are extremely pleased to be working with such innovative organizations and look forward to exploring how we can support traditional insurance and reinsurance, as well as open up digital asset risk capacity to capital markets.” – Benjamin Peach, Associate Director & Digital Assets Specialist, Global Broking Centre at Aon.

“As the digital asset space soars to $1 trillion, the need for appropriate insurance protection to scale alongside that growth will be vital for the sustainability of this innovative market. By working with Aon and Relm, we are enabling the collaboration between technology, regulation and the existing insurance marketplace, bringing a robust solution for the cover of digital asset risk to the market.” – Dan Roberts, CEO at Nayms.

“We launched Relm in 2019 in order to bring to the insurance market informed and dedicated capacity for digital asset and blockchain businesses. To that end, we are excited to be working with Nayms and Aon in an area of the insurance sector to which we are fully committed and see great potential. In addition to supporting numerous digital asset companies all over the world with financial and professional lines coverage, the Nayms platform will enable Relm and Aon to transact insurance in a manner that creates more alignment with our target insureds.” – Joseph Ziolkowski, CEO at Relm.