Alto raises $40 million

Alto Solutions, the self-directed IRA platform backed by New York Life Ventures, has closed a $40 million Series B round. Advance Venture Partners was the lead on this round of funding, with additional participation from existing investors including Unusual Ventures, Acrew Capital, Alpha Edison, Foundation Capital, Gaingels, and Coinbase Ventures.

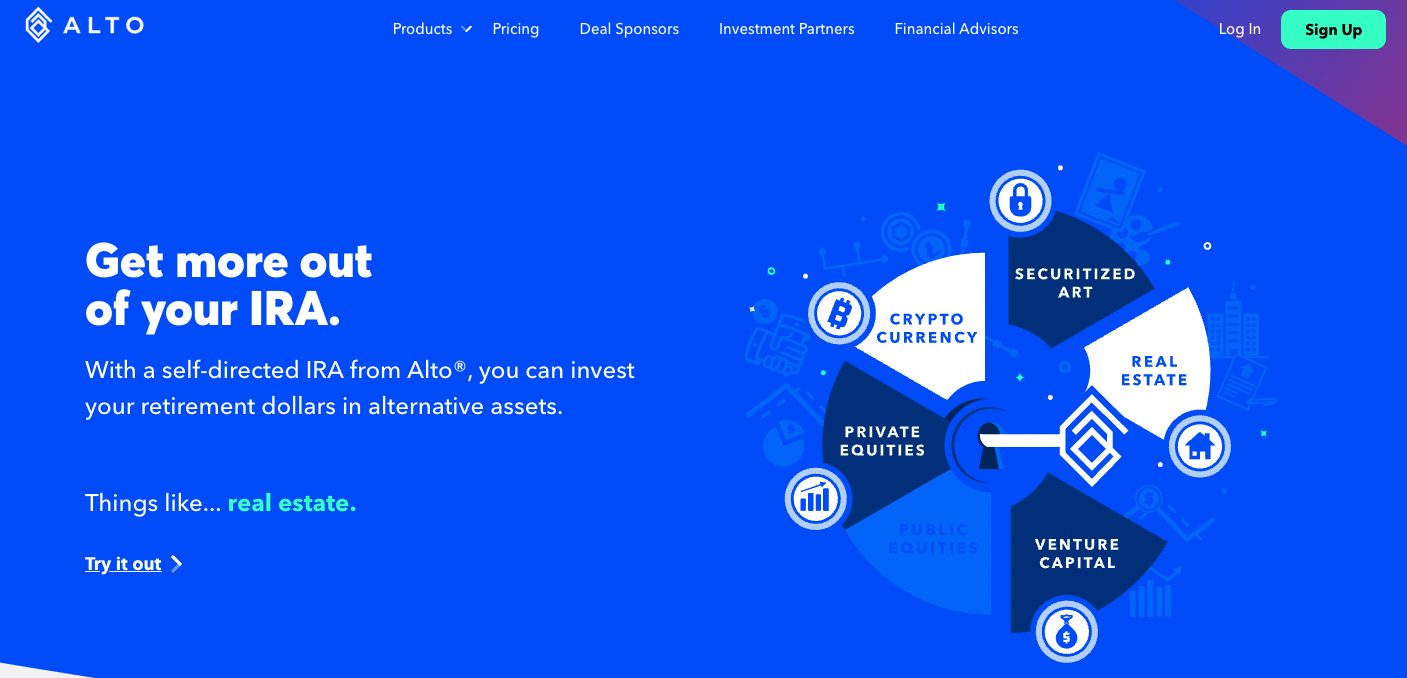

Founded in 2018, the fintech startup is on a mission to make it easy for individuals to access and invest in alternative assets such as private equity, venture capital, real estate, and crypto using their retirement funds. Alto counts nearly 20,000 funded accounts representing close to $1 billion in assets.

“I am proud of the success of the Alto team to date and grateful for the continued confidence of many of our core investors in this latest funding round. We believe this funding will provide more individuals looking to control their financial future with easy and affordable access to high-growth, diversified, non-traditional asset classes typically reserved for the wealthiest investors, including private equity, venture capital, real estate, securitized artwork, and crypto.” – Eric Satz, founder and CEO of Alto.

“Advance Venture Partners is thrilled to have led Alto’s Series B financing. We have followed Alto’s progress and believe that the company is well positioned to transform how millions of everyday investors manage and invest their retirement savings. Alto is attacking an IRA market that, despite representing trillions of dollars in assets, still struggles with antiquated processes and legacy service providers. We’re excited to back Eric Satz and a top-flight team that is removing friction from this market and enabling investors to seek both better returns and better diversification of their retirement portfolios.” – David T. ibnAle, founder and Managing Partner of AVP.

“Alto has a clear vision to give everyday investors a seat at the table for investment opportunities that reflect the future. Alto has shown incredible momentum, especially over the last 18 months, connecting alternative opportunities in crypto, private equity, and other asset classes, with the often overlooked $37 trillion retirement account market. We are thrilled to continue to invest in Alto’s mission to make alternative investing accessible to everyone.” – Sarah Leary, venture partner at Unusual Ventures.