NTUC Income launches SNACK

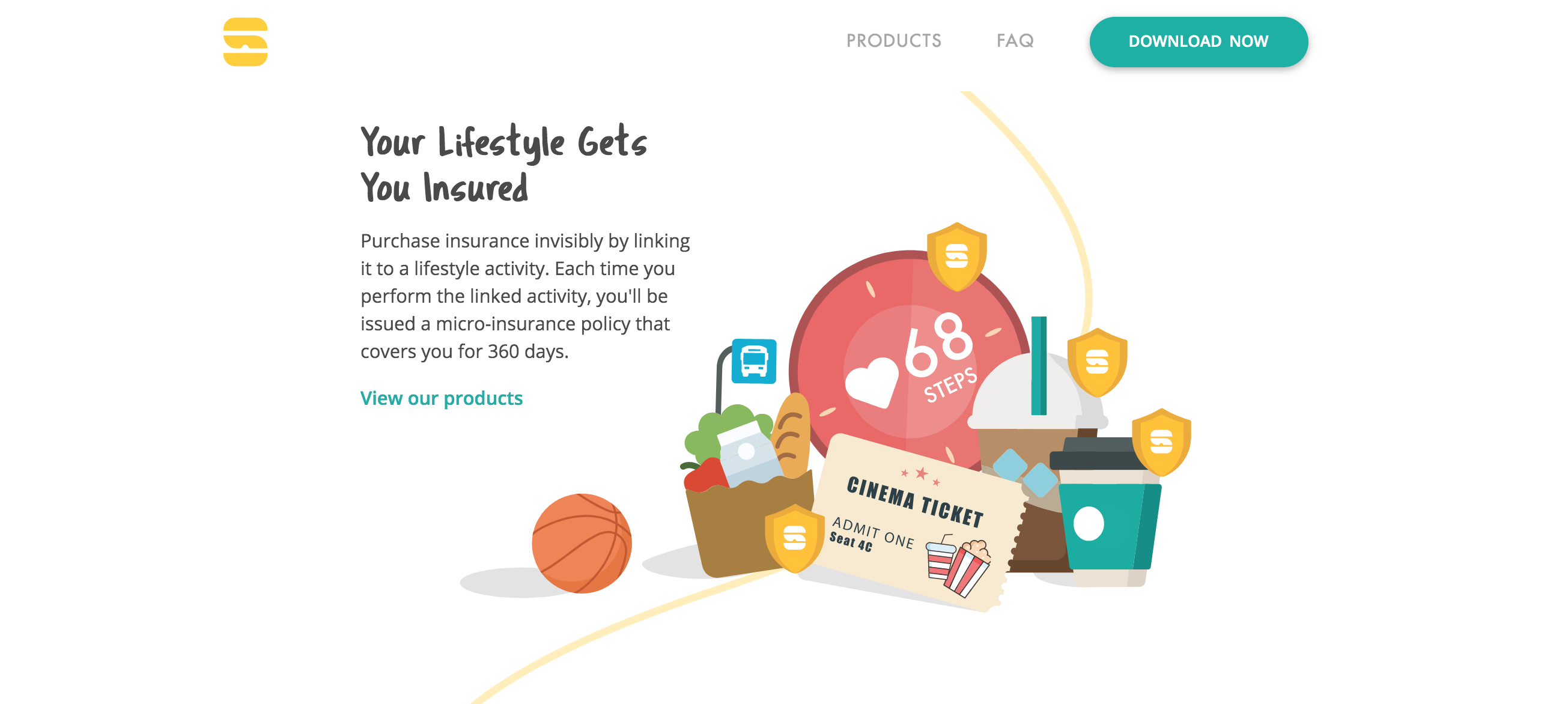

Income has launched SNACK. With SNACK, the insured gradually builds or stacks his insurance coverage by paying micro-premiums at either $0.30, $0.50 or $0.70, to accumulate micro-policies that offer a specified sum assured that corresponds with the premiums paid. The SNACK insured can also decide when and how frequent premiums are paid by linking them to his preferred lifestyle triggers, such as ordering a meal, exercising, or taking public transport.

Also, each micro-policy, which is issued when a micro-premium is paid, covers the SNACK insured for 360 days. This means that the insured stays protected over time even when he stops using his lifestyle triggers or if the weekly cap is reached.

“Today’s consumers are empowered individuals who are well informed, and seek choice, convenience and personalization in the products and services they engage with, and insurance is no exception. By reimagining insurance, SNACK is offering consumers new freedom and flexibility in protecting themselves, just by going about their daily activities. This makes insurance more accessible and relevant to everyone, keeping it easily adaptable to lifestyle needs and personal financial situations.” – Peter Tay, Income’s Chief Digital Officer.

Currently, SNACK has partnered with EZ-link, Fitbit and Burpple to enable insureds to accumulate Term Life (TL), Critical Illness (CI) and Personal Accident (PA) insurance coverage on the SNACK mobile app each time they pay for their public transport using their EZ-link card, clock 5,000 steps a day on their Fitbit or redeem a dining/ takeaway deal on Burpple Beyond.

Finally, Visa cardholders will be able to create triggers based on their retail, entertainment, transport, and grocery purchases. “This means that a SNACK insured will be able to stack his insurance coverage in TL, CI and PA insurance more accessibly, and potentially reached maximum sum assured quicker, with more lifestyle trigger options.”

“SNACK is designed to offer simple access to insurance and breaks down the complexities of it, especially for those who are new to insurance. It provides a novel touch-point that speaks to anyone who sees the value of stacking insurance coverage conveniently and intuitively as they go about their day-to-day activities. For those who already have existing insurance plans, SNACK can complement or enhance their existing coverage without adding any financial burden. With its micro-premium and stackable coverage propositions, we believe SNACK is the future of insurance as it enhances insurance accessibility and ultimately, bridges protection gaps and fulfills a larger purpose of getting everyone meaningfully insured. More significantly, SNACK is highly scalable as it holds great potential for more insurance offerings such as savings and investment options, and new lifestyle triggers to be included in the proposition so that it continues to resonate with customers from all walks of life and diverse financial needs” – Tay.