One raises $17 million

One Finance , the startup behind a new digital banking service that “will help middle-class American families maximize their paychecks,” announced a $17 million Series A round from Foundation Capital, Core Innovation Capital, and Obvious Ventures, which brings its total funding raised to $26 million.

One is co-founded by Bill Harris, who is the former CEO of Intuit, the founding CEO of PayPal and founder and former CEO of Personal Capital, and Brian Hamilton, who is the founding CEO of Azlo (another digital bank backed by BBVA), co-founder of PushPoint, a company acquired by Capital One, and a former SVP at Capital One.

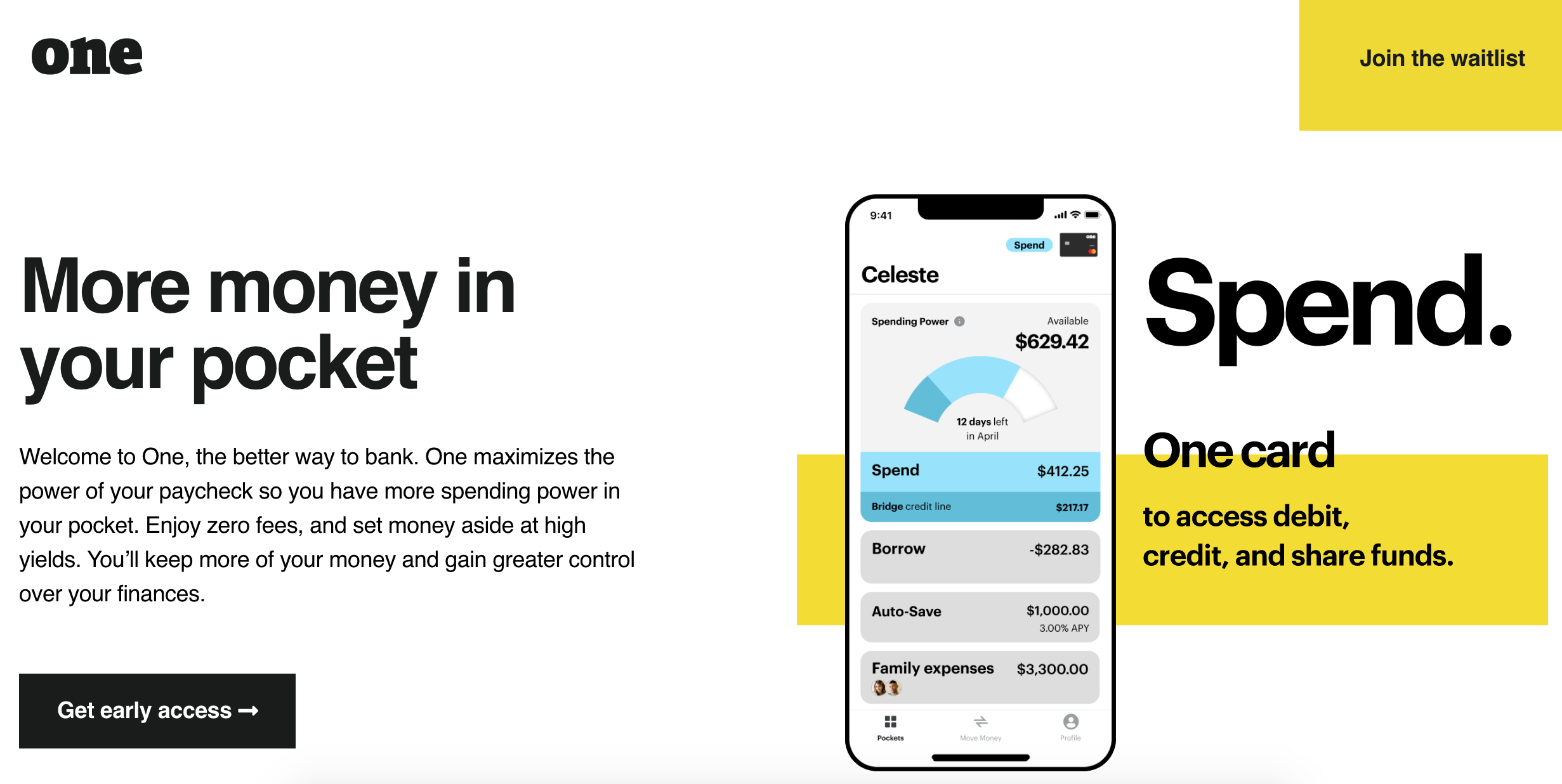

The company is “redesigning the key fundamentals” of banking to help people save more, spend less and gain control of their finances. Two notable features are a single card for both debit and credit, and the ability to create ‘pockets’ within a single account to instantly share money with others, eliminating complicated transfers between banks or accounts. Customer funds are held at Coastal Community Bank.

“There’s a gap in the market that’s not being met. Traditional banks cater mostly to affluent customers and new digital banks target younger individuals with simpler financial needs. Middle-class American families are being left out, and we built One specifically for them. One will combine the technology and convenience of challenger banks with a full-suite of products that traditional banks offer.” – One Chairman Bill Harris.

“The current financial system breaks up the money people earn into siloes, making it hard for busy families to stay on top of their banking and credit accounts. Most people have a balance in their checking account that earns nothing and outstanding debt on their credit card that costs too much. One is designed to maximize a family’s hard-earned paycheck by unifying saving, spending and borrowing into one account. When this money is being managed from one place, people save more, are charged less and gain control.” – One CEO Brian Hamilton.