Grab & Income Launch Microinsurance Product

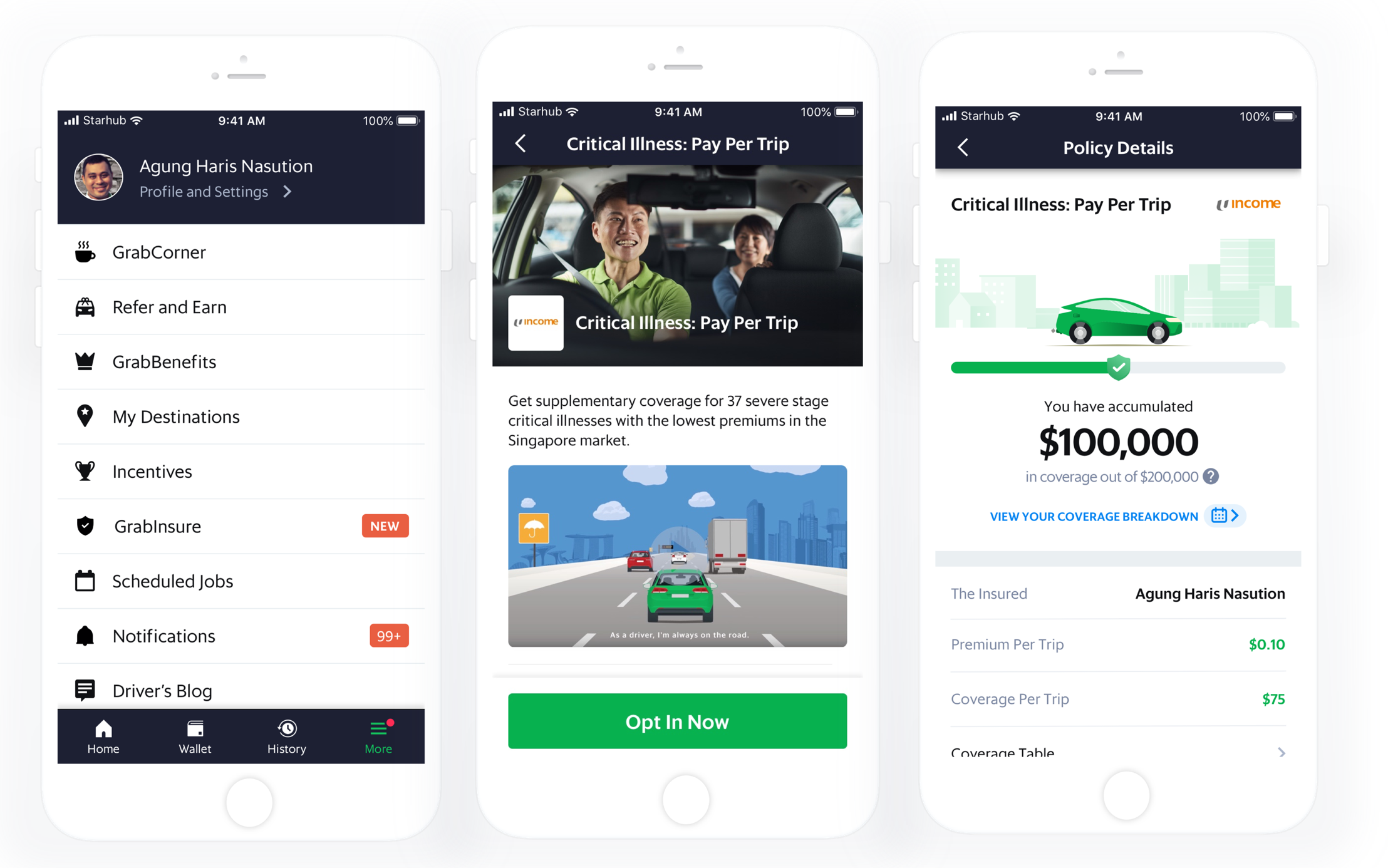

Grab’s insurance arm, GrabInsure and NTUC Income are now offering a microinsurance plan against critical illness in Singapore for Grab driver-partners who are 18 to 75 years of age.

Specially designed to help Grab driver-partners better protect themselves against critical illnesses, CIPPT (Critical Illness: Pay Per Trip) offers a pay-per-trip micro premium and accumulative coverage proposition. The driver-partners can choose to pay between S$0.10 and S$0.50 in premium for a fixed sum assured, and accumulate the corresponding insurance coverage with each trip they complete. Also, they can subscribe to the plan via the Grab driver-partner app and with each completed trip, have the CIPPT premiums automatically deducted from their in-app cash wallet.

CIPPT is the latest digital insurance product offered by GrabInsure, after the launch of Personal Accident Plus (PA+) and Prolonged Medical Leave Plus (PML+) insurance plans in April 2019.

Refresher: GrabInsure is a digital insurance marketplace set up by a joint venture between Grab and ZhongAn Technologies Insurance International.

Get Coverager to your inbox

A really good email covering top news.

Allianz withdraws offer for Income Insurance