Leap Life Launches Personalized Platform

LeapLife has announced the launch of its digital life insurance platform.

“The life insurance industry is on the verge of the next phase of innovation. Regardless of age, health status or credit standing, all people deserve access to good insurance, at an affordable rate, through a seamless online process. It’s our goal to democratize this process through our digital platform.” – CEO and Cofounder of Leap Life, Tom Patterson.

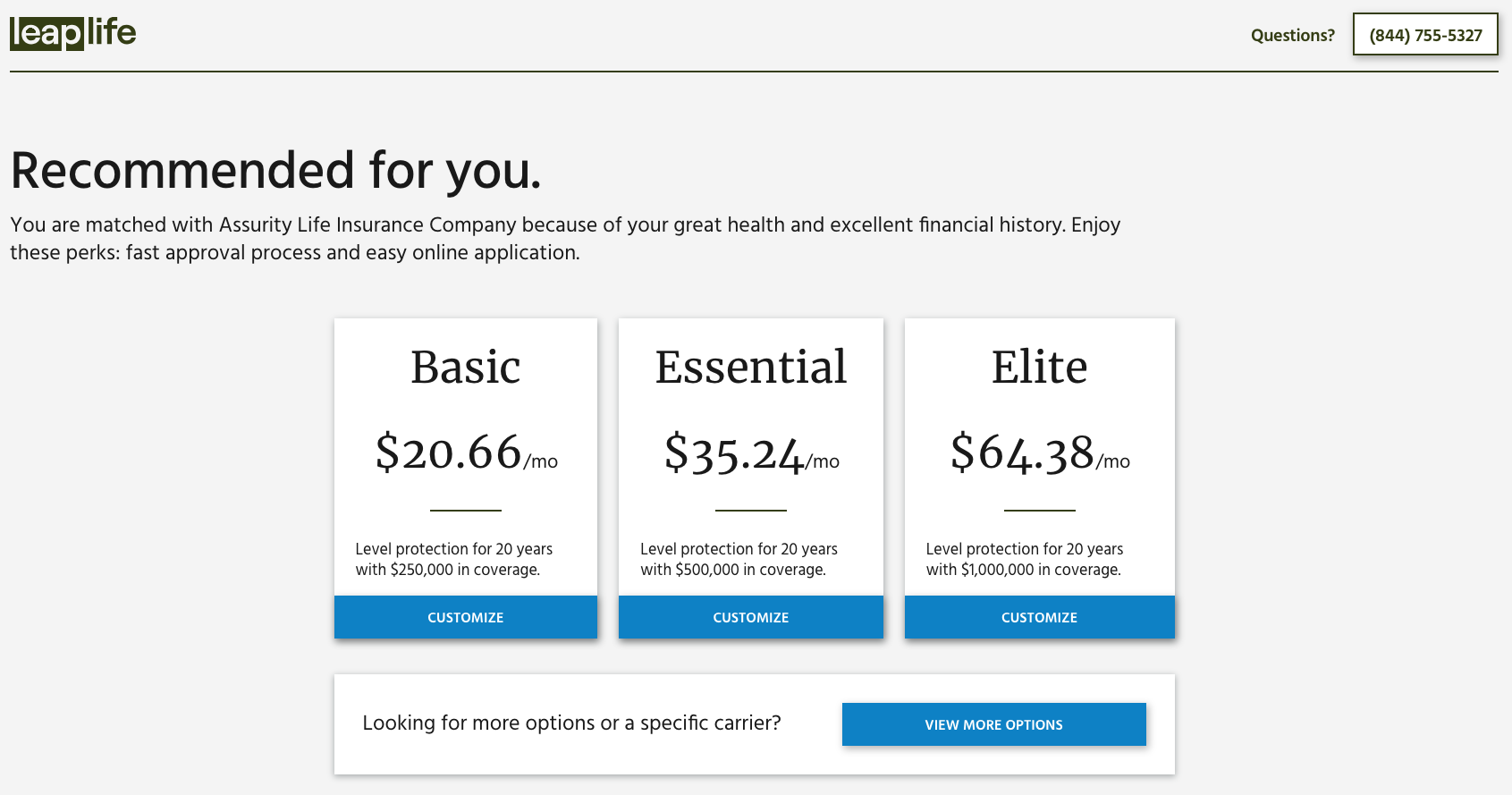

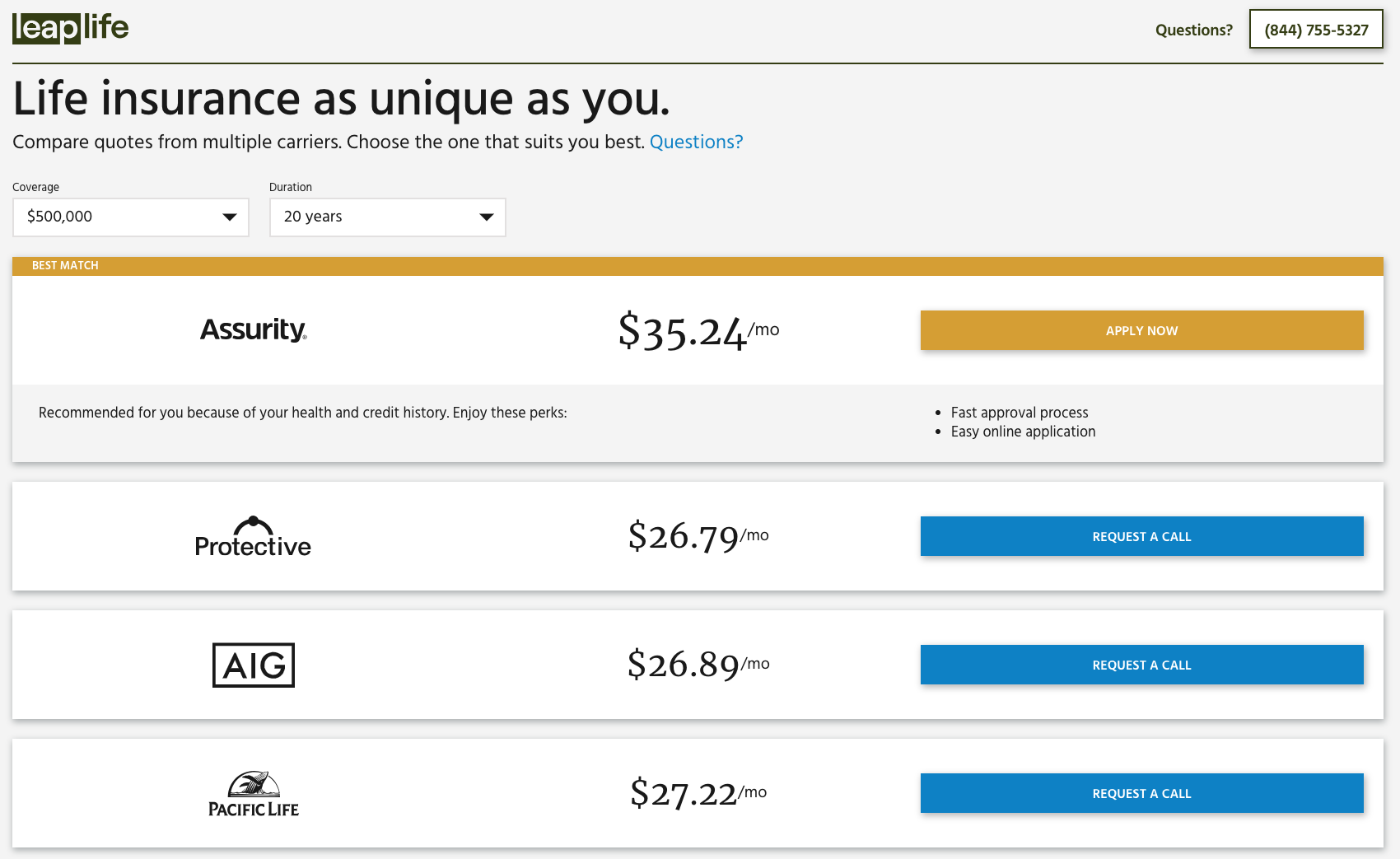

Based on analysis work Leap Life has modeled internally, from analyzing thousands of data points, the majority of consumers (up to 80 percent) can pay anywhere from 50-300% more for their life insurance policy, if they use the wrong carrier. Standing behind its mission that families deserve better, Leap Life offers transparent life insurance policies matched to each person’s unique situation.

Leap Life has partnered with Pacific Life, Lincoln, Mutual of Omaha, Protective and others, to create a life insurance buying experience matched to different population segments. The company is backed by RGAX, the transformation unit of global reinsurer Reinsurance Group of America, Incorporated, and Assurity, an innovative life insurance carrier.

“At RGAX, we are focused on transforming the life insurance industry, and we strategically partner with strong insurtechs, like Leap Life, that will drive the greatest industry impact.” – Managing Director of RGAX Americas, Chris Murumets.

Leap Life also works with Credit Sesame, Insurify and others to offer consumers increased convenience and access to a digital insurance experience wherever they are on the web and whatever their personal situation may be.

“We believe that the life insurance industry is changing rapidly, and we are leading the change with innovative insurtechs such as Leap Life.” – Head of Corporate Venture of Assurity, Jared Carlson.

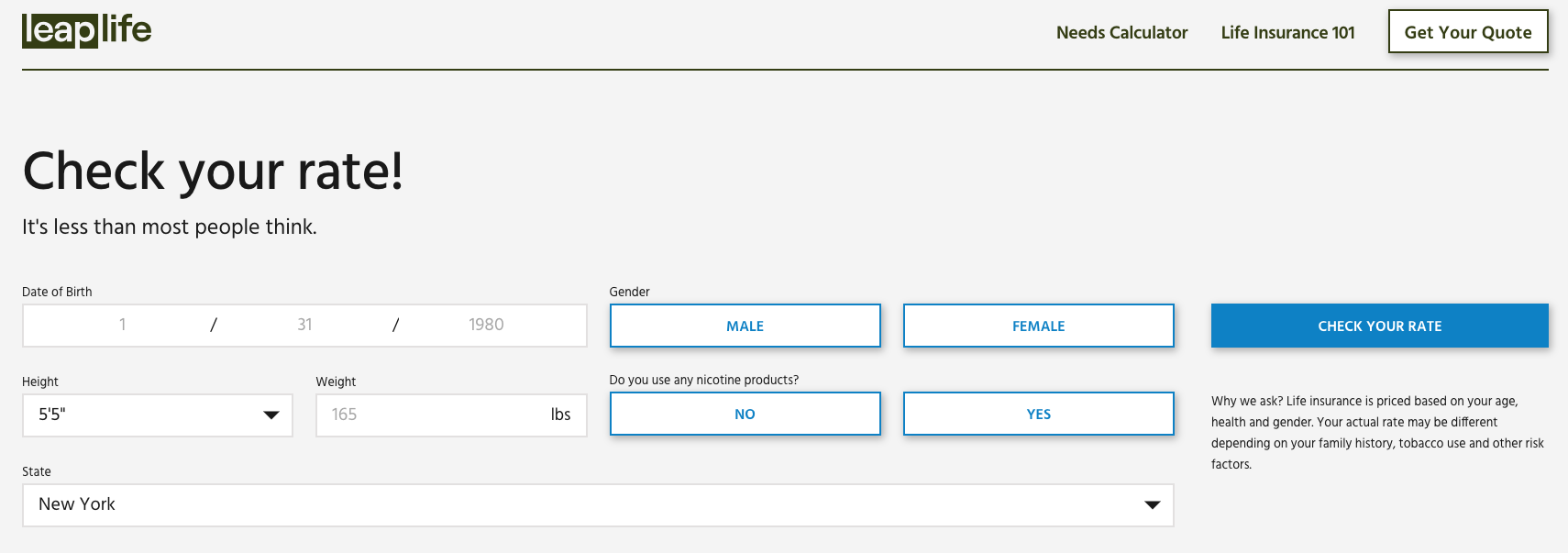

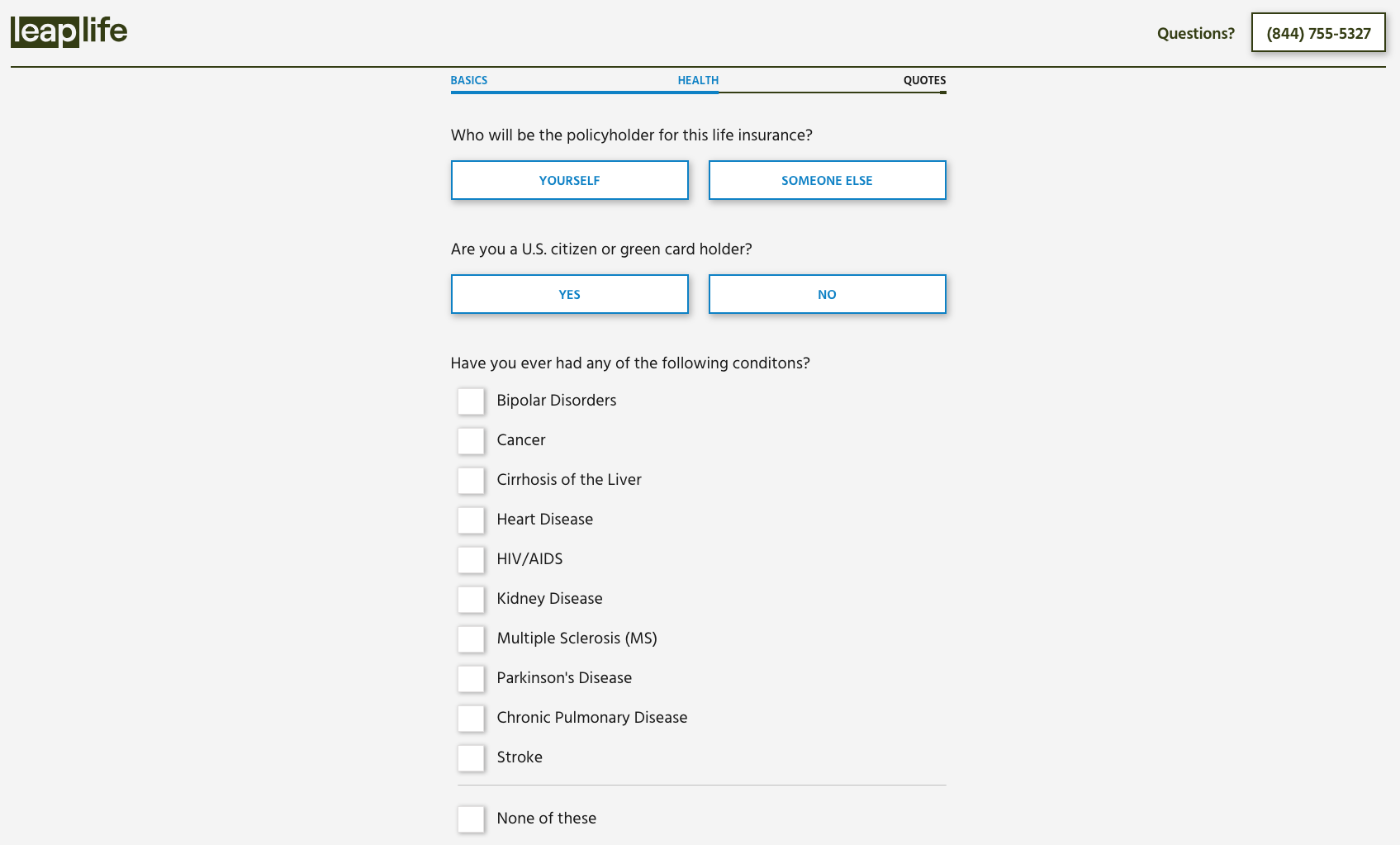

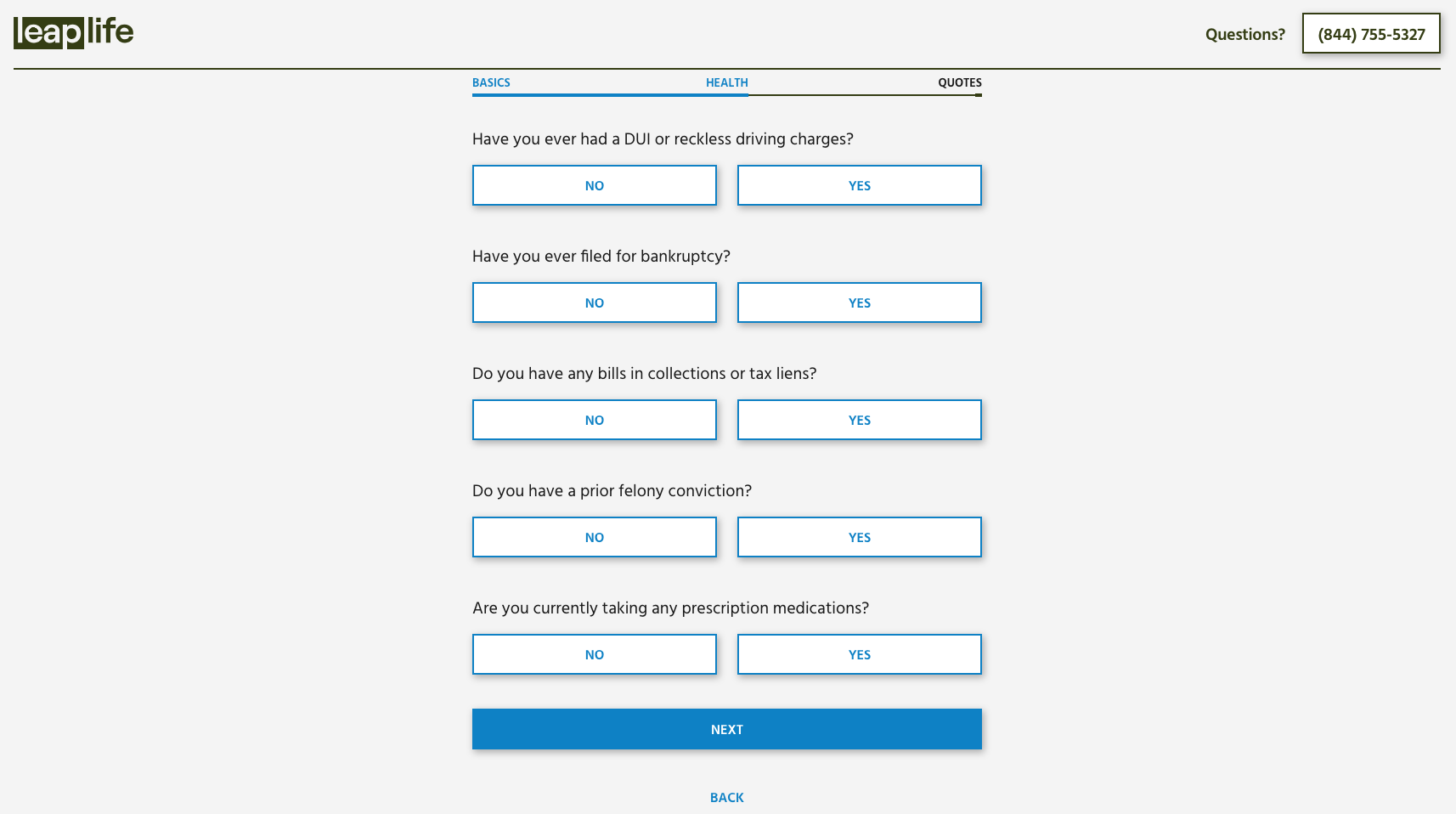

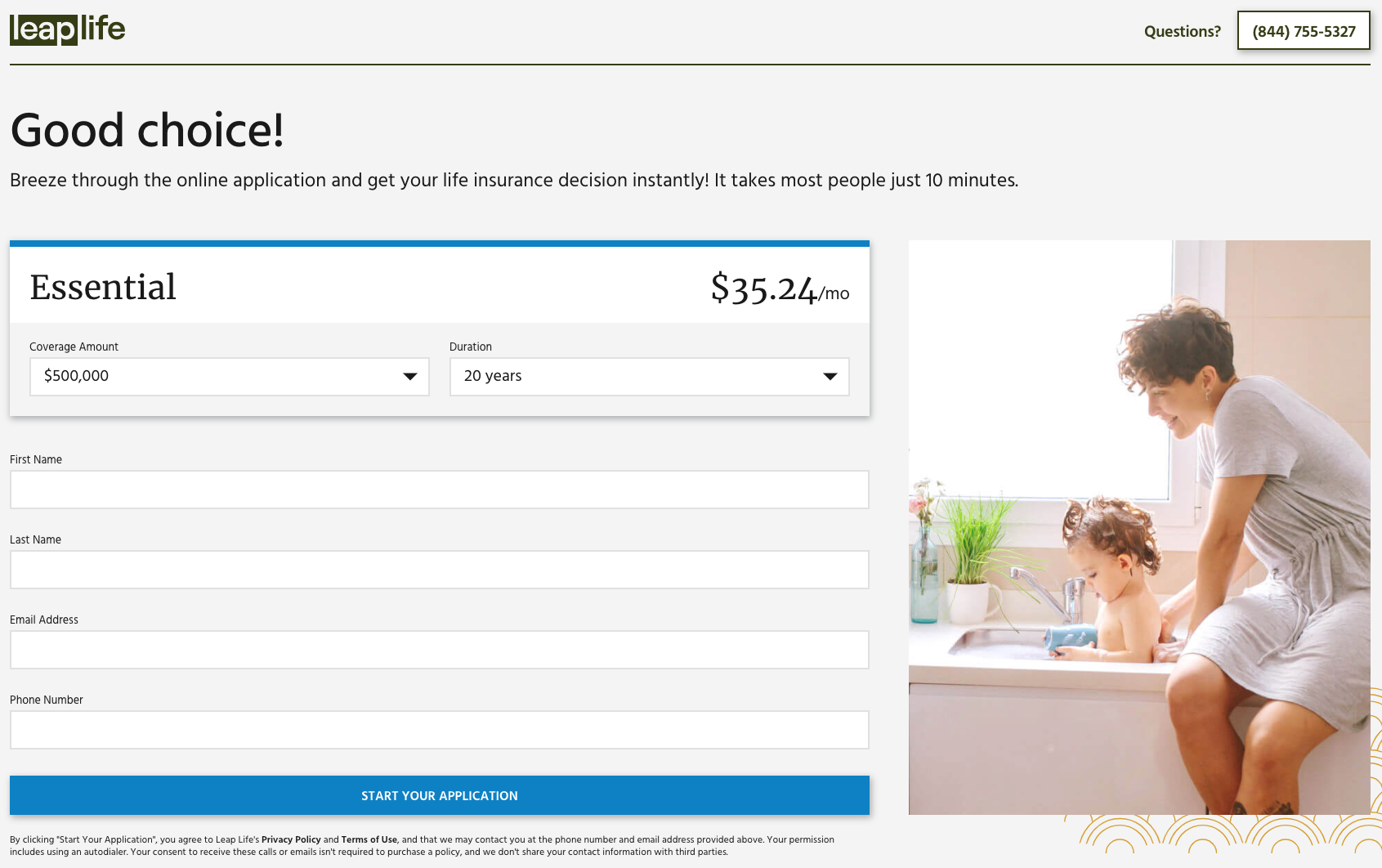

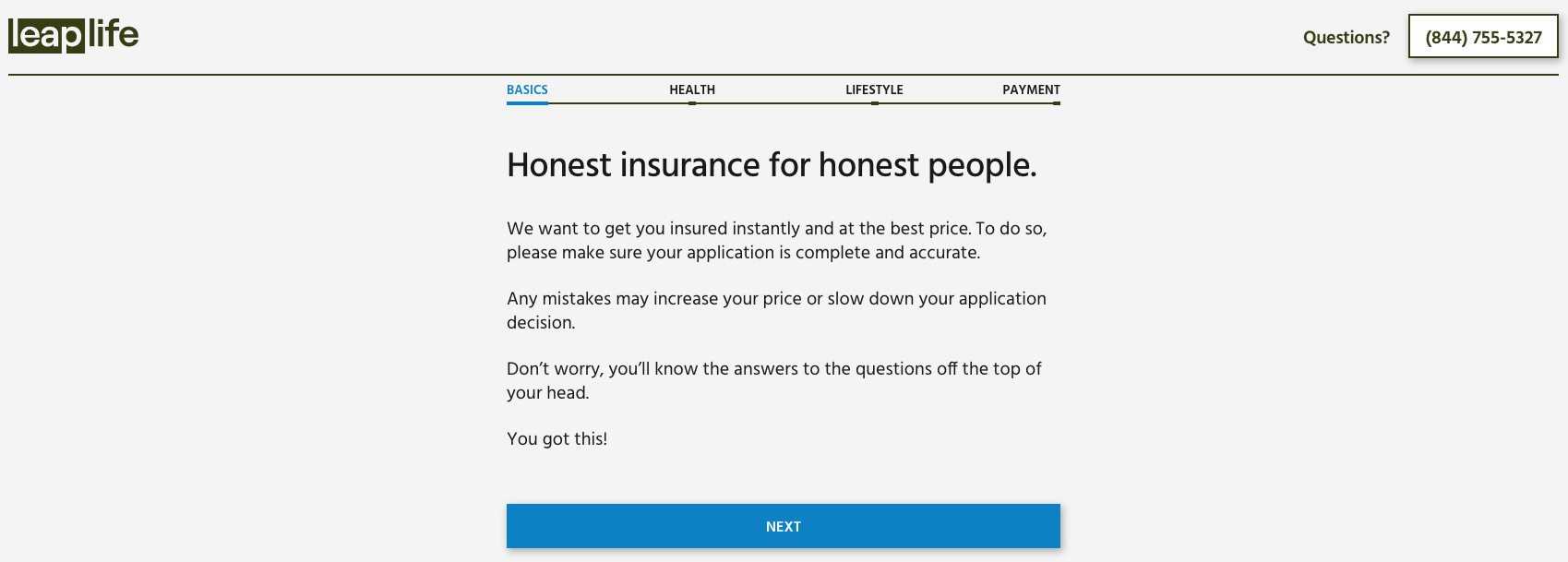

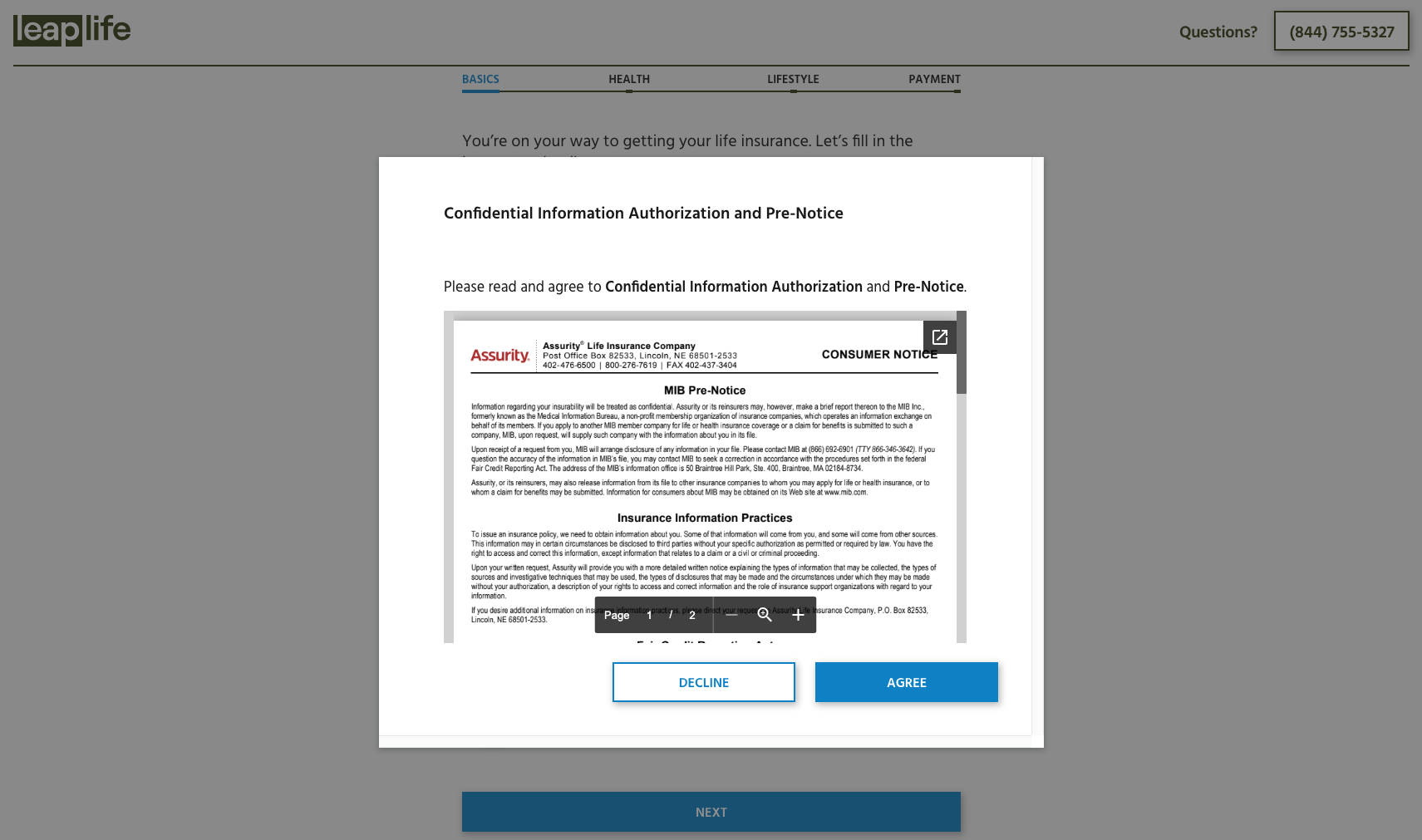

Get a feel for the flow below:

Get Coverager to your inbox

A really good email covering top news.

RGA launches Plan V Care