How one Parisian insurtech crossed the t

Meet +Simple; a Parisian startup targeting small business insurance shoppers . Better yet, a unique digital broker targeting small business insurance shoppers. Keyword: unique. The one-year-old commercial digital broker, with $1 million in funding, was founded by three guys on a mission (think: Eric, Anthony, and Salah), and has already managed to secure the attention of Generali; to name one insurer.

The gist. Below.

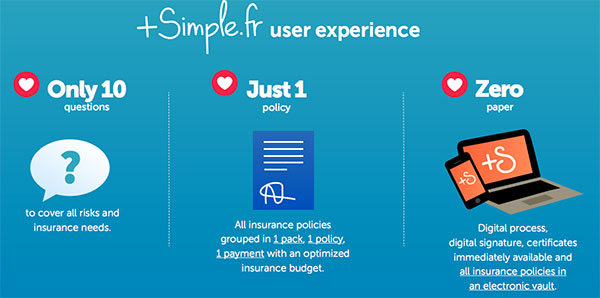

Simple UX.

Customers can quote and bind online as well as obtain a certificate of insurance. In real-time. Because some things are worth emphasizing.

So instead of this:

Imagine this:

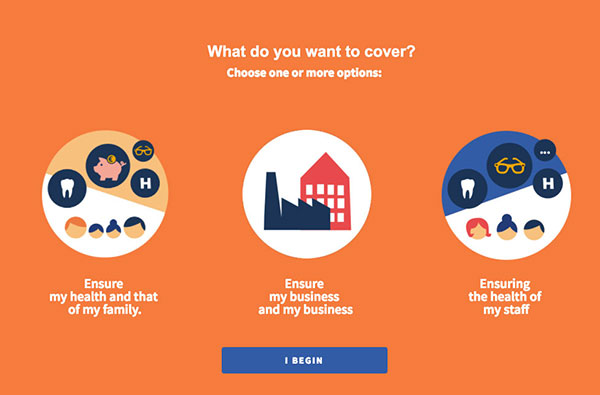

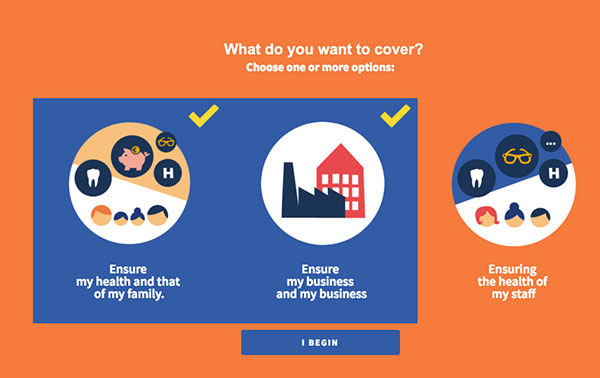

Get a feel for the startup’s UX below (or play the video, here).

One policy.

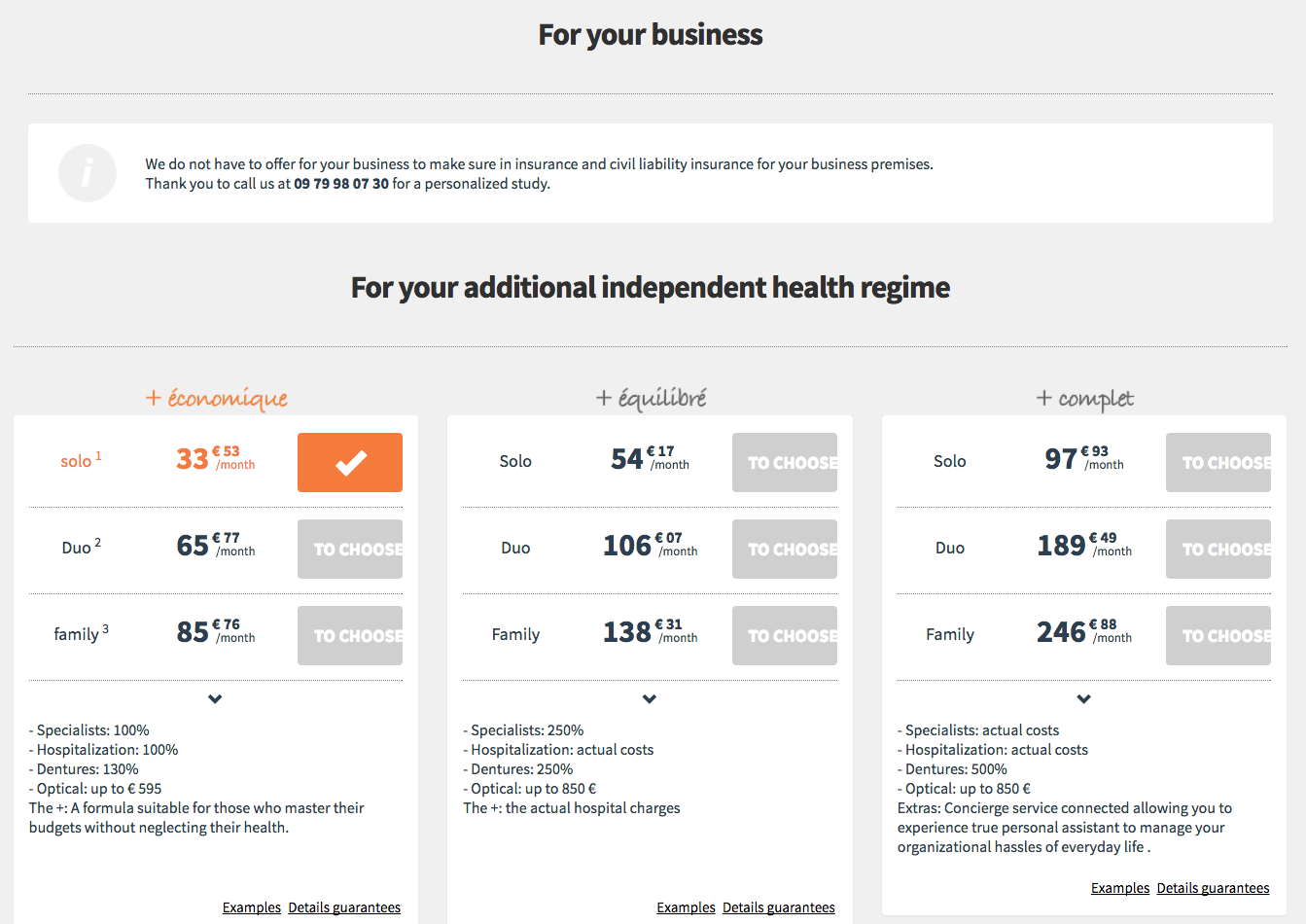

+Simple offers one policy that covers “95% of the coverage needs” of small business insurance shoppers, according to founder and president Eric Mignot. In other words, in one single flow, customers can purchase business (think: contents, legal protection, professional liability etc.) and health insurance and end up with a single combined insurance policy. View sample proposal, here.

One payment.

Also, +Simple has the delegated authority to offer customers a combined payment.

One contact number when karma happens.

Last, +Simple has the authority to approve claims within its jurisdiction. In other words, clients can contact the agency and in certain cases see their claims be resolved in no time.

B2B2C + D2C Distribution Strategy.

+Simple works mainly with partners such as brokers, chartered accountants and banks that look for an efficient way to target the low-end segment of small business. In these instances, +Simple offers a co-branded platform. In addition, +Simple attracts customers directly via its website.

What’s next?

Product and geographic expansion.

Bottom Line: digital distribution meets product innovation meets the A-Team , aka folks that have dotted the i’s and crossed the t’s, because the devil is in the details.