Introducing Milford Street Association Captive Insurance Company

A new collective called Milford Street Association Captive Insurance Company was launched last month by landlords of 80,000 apartments with regulated rents and government financing, according to a Gothamist article by David Brand. The collective allows members, who must be New York-based with capped rents and government financing, to pool their money to cover claims, potentially reducing insurance costs and improving building conditions for tenants.

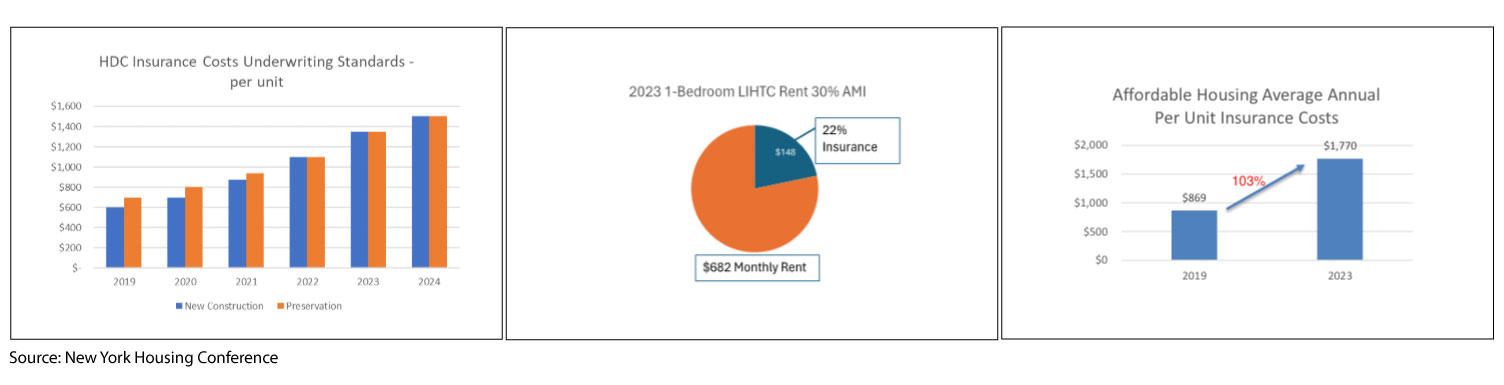

A report by the New York Housing Conference found that insurance rates for affordable apartments in New York City more than doubled between 2019 and 2023, with the average cost per unit rising from $869 to $1,770. The report, titled “The Alarming Risk of Rising Insurance Costs for Affordable Housing,” collected data from 18 partners on insurance policies and pricing covering over 130,000 housing units. It indicates that insurance premiums are skyrocketing while coverage is decreasing or becoming difficult to find. The report found that insurance costs now represent 22% of monthly rent for an extremely low-income household’s Low Income Housing Tax Credit (LIHTC) 1-bedroom affordable apartment, highlighting a growing threat to affordability. Rising insurance costs are attributed to climate change, fewer insurance companies offering multifamily coverage, changes in the reinsurance market, inflation, and discrimination. The report also notes that insurance carriers often discriminate against affordable housing based on income source and level, with many refusing to insure developments in New York City.

Milford Street Association Captive Insurance Company is a client of ArentFox Schiff.

Bottom Line: “If you don’t solve this insurance cost problem, you will not have affordable housing,” according to John Crotty, a member of the collective and founder of Workforce Housing Group.