Getting Started with Generative AI in Insurance: Benefits and Use Cases

In 2023, generative AI took the spotlight, emerging as the most talked-about technology of the year. This content creating powerhouse can do everything from text, image, and video generation to answering questions through natural language queries. And its potential uses are vast.

While many industries are still in the experimental phase, the insurance sector is poised to benefit significantly from the integration of artificial intelligence into its ecosystem.

[Get the 2024 AI Outlook: Expert Advice on Navigating the AI Economy]

Key benefits of generative AI for insurance.

Gen AI has the potential to reshape the insurance value chain, enhancing productivity and delivering increased customer satisfaction. From product design and development to underwriting processes and claims management, the possibilities are endless.

Let’s delve into some of the key benefits of generative AI:

- It unlocks more value from enterprise data. By analyzing vast volumes of unstructured customer data across marketing, underwriting, claims, and control functions, generative AI can surface new insights. For example, gen AI could be used to develop customer segments and conduct product comparisons to develop new hyper-personalized offerings and to improve customer engagement.

- It speeds up work and processes. By automating routine tasks—like manual data entry and document and email classification—and using AI-generated insights, underwriters can significantly reduce the time they spend on administrative work to accelerate quote generation and claims processing.

- It identifies hard-to-detect risks and inefficiencies. Because it can identify patterns and anomalies in data, generative AI is a powerful tool for fraud detection and risk assessment. With it, insurers can make better underwriting decisions, prevent fraudulent claims, and reduce claims leakage—all leading to less financial loss.

- It delivers personalized, timely customer experiences. Generative AI streamlines customer service center operations by automating routine service tasks and providing agents with data-based insights to resolve customer inquiries more effectively.

Top 5 insurance use cases for generative AI.

With its ability to analyze data, generate content, and make predictions, generative AI offers a wide range of use cases for insurance companies. Insurers that embrace it stand to gain a competitive edge by leveraging its capabilities to meet the evolving needs of their customers and the industry.

The top use cases for generative AI include:

- Underwriting. Generative AI can assist underwriters in evaluating potential risks by analyzing vast amounts of data, including historical claims, customer information, and external factors to generate risk profiles and recommend appropriate coverage levels, helping underwriters make more informed decisions quickly.

- Claims processing and fraud detection. Generative AI can streamline the claims process by automating the assessment of claims documents. It can extract relevant information from documents, summarize claims histories, and identify potential inconsistencies or fraudulent claims based on patterns and anomalies in the data.

- Quote and policy generation. Generative AI can automate the generation of insurance quotes, policies, and associated documentation. It can create quotes, policy documents, invoices, and certificates based on predefined templates and customer information, reducing manual administrative tasks.

- Customer support and engagement. AI-powered chatbots reduce the workload on human agents and provide 24/7 customer support to offer immediate answers to policy, coverage, and claims questions. Generative AI can also automate personalized communication with policyholders by sending reminders for premium payments, providing policy updates, and delivering relevant content to enhance customer engagement and retention.

- Customer upsell/cross-sell opportunities. Generative AI can analyze customer data and preferences to recommend tailored insurance products. By understanding customer needs and risk profiles, insurers can offer personalized coverage options, increasing the likelihood of upselling or cross-selling additional policies.

The versatility of generative AI in the insurance industry is immense, and its power cannot be overstated.

But there’s a big gap between knowing what AI can be used for and operationalizing it in your organization. That’s where strategic technology partners can help.

[Avoid common artificial intelligence pitfalls. Get the guide to implementing private AI.]

Generative AI in action.

Embracing AI isn’t a bold move; it’s a necessary step towards the future of work in the insurance industry. And it requires significant behavior and mindset shifts for successful, sustainable transformation.

Appian’s approach to AI is one of pragmatism. Appian empowers you to protect your data with private AI and provides more than just a one-off, siloed implementation. Appian is your gateway to the productivity revolution, helping you operationalize AI across your organization and streamline end-to-end processes.

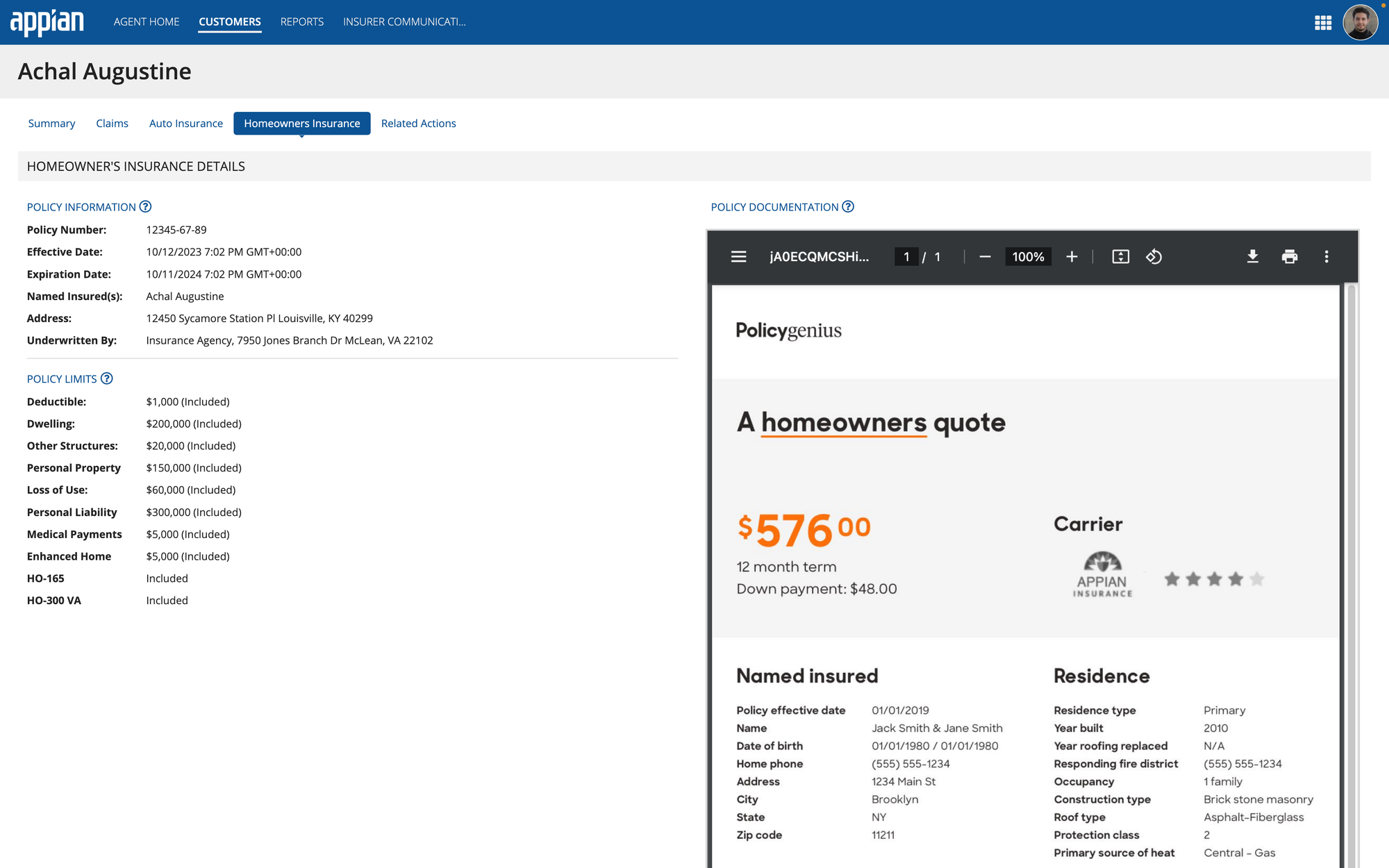

For example, with Appian’s AI document extraction and classification, insurers can automate the manual work of analyzing policy documents. Or they can chat with AI Copilot to answer questions about a customer policy or claim.

Generative AI has the potential to revolutionize the insurance industry, and those who can operationalize it responsibly will be at the forefront of this exciting journey towards the future of insurance.

Document extraction powered by Appian AI.

Ready to start your generative AI journey?

Appian partner EXL is actively working to explore the vast potential of generative AI and help insurers unlock the full power of this technology within the Appian Platform.

Get the guide to driving responsible generative AI adoption in the insurance industry.