Misrepresentations and acquisitions at insurtech Zywave

In a legal battle unfolding in California, Zywave, a company with three decades of experience in the insurance software sector, has initiated a lawsuit against its insurer, Travelers Excess and Surplus Lines Company, a subsidiary of Travelers . The crux of the dispute lies in allegations that Travelers breached their contractual obligations by failing to cover $10 million in damages. These damages, Zywave contends, stem from misrepresentations provided by ClarionDoor, a property and casualty (P&C) insurance software firm that Zywave acquired in late 2021.

Founded in 1995 and headquartered in Milwaukee, where it has “a really good bar,” Zywave is under the ownership of Clearlake Capital and Aurora Capital. It focuses on front-end technology such as submissions and ratings with an eye on underwriting workbenches, serving ~15k brokers by offering tools to enhance client management and optimize workflows.

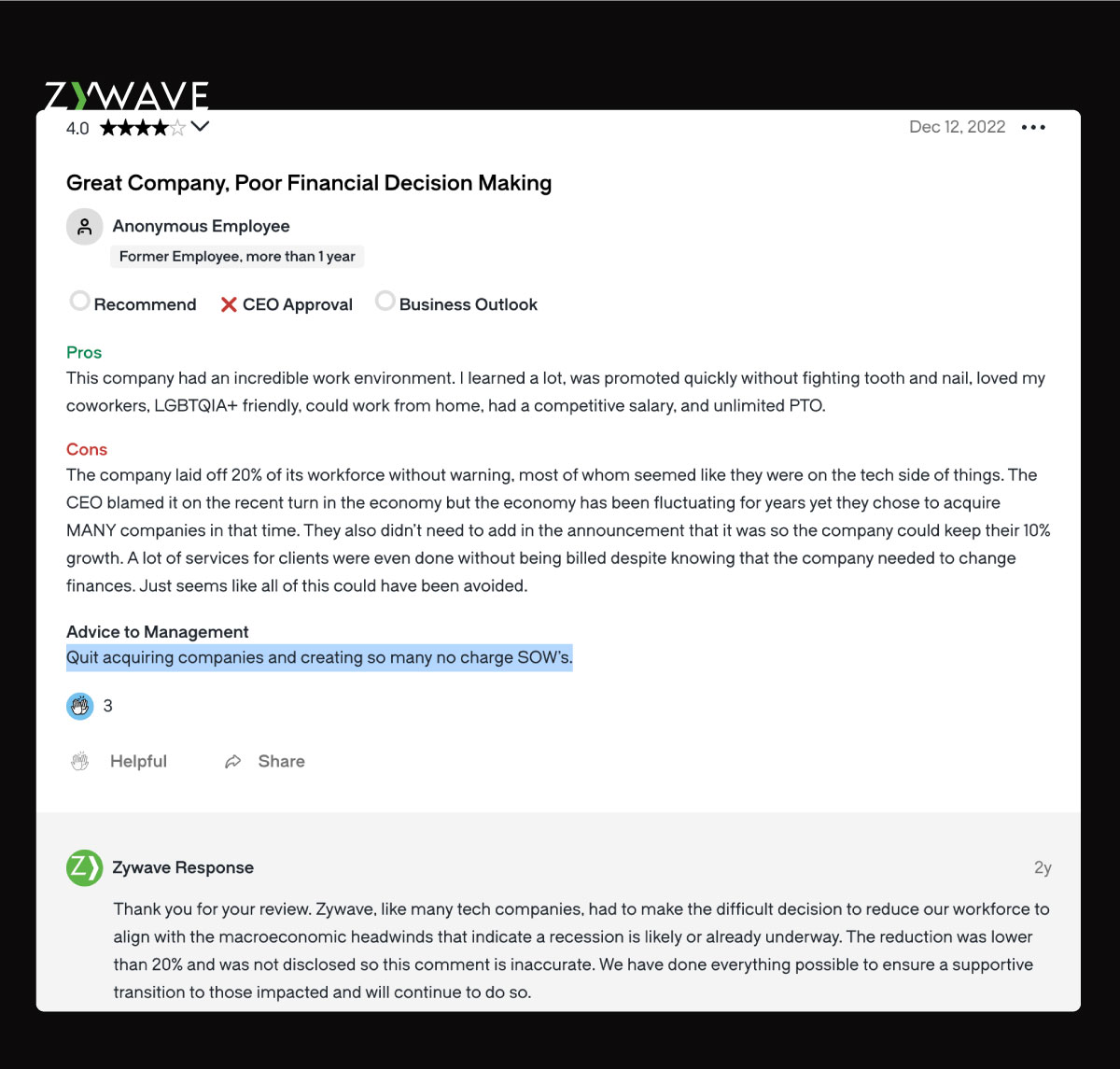

Over the past two years, it experienced a significant reduction in its workforce, which had over 1,000 employees as of Oct 2023. This contrasts with its main competitors, Applied Systems and Vertafore, which have both expanded their teams by 17% over the past two years. Anonymous reviews on Glassdoor paint a picture of a company grappling with at least two layoffs in the past year. One reviewer criticized the lack of innovation, stating, ‘The products are “boring,” and we can only watch as the leading names in the industry outpace us in every area except content. The strategy of acquiring companies without integrating or updating their products has resulted in stagnation. It’s been five years, and some products remain isolated.’ Another review highlighted inadequate partner engagement and an overwhelming workload for the limited partner success staff.

Under the leadership of Jason Liu, who has helmed Zywave for nearly six years, only 49% of employees who submitted reviews on Glassdoor would recommend the company to a friend, and a slight majority of 52% approve of his leadership. It is during Liu’s tenure that Zywave has earned the title of ‘the most acquisitive software company in the insurance industry,’ having acquired 10 firms and spent close to $1 billion. ClarionDoor, the company’s ninth acquisition, is a testament to this expansion strategy.

| # | Acquired by Zywave | Year | Description |

|---|---|---|---|

| 1 | SIS | 2022 | AMS and CRM solutions for P&C agencies |

| 2 | ClarionDoor | 2021 | Insurance product distribution software for carriers |

| 3 | IBQ Systems | 2021 | Personal lines comparative rating |

| 4 | Modgic | 2021 | Workers’ comp and mod analysis software |

| 5 | Enquiron | 2021 | Risk management and consultative business solutions |

| 6 | ITC | 2020 | Marketing, rating, and management software and services |

| 7 | Advisen | 2020 | Daily P&C email |

| 8 | miEdge | 2019 | Provider of lead generation, data analytics and prospecting solutions |

| 9 | RateFactory | 2019 | Small group rating engine |

| 10 | Code SixFour | 2018 | Proposal automation and predictive analytics for employee benefits advisors |

“We bought the best carrier and MGA rating product on the market called ClarionDoor rated by Celent as the best rating product,” Liu remarked in Oct 2023. Now, Zywave is arguing that it’s entitled to coverage under a representations and warranties insurance policy tailored for the buyer and sold via Hays Companies, a Brown & Brown agency, while ASQ Underwriting is the authorized agent of the insurer. The policy – with a premium of $425,000 – was secured specifically for the 2021 acquisition of ClarionDoor. In the lawsuit filed on Feb 14, Zywave states that it informed Travelers on Nov 29, 2022, that the seller had violated certain agreements. Then, on Sep 14, 2023, Travelers admitted that the seller probably didn’t keep to some important promises made during the sale, especially regarding two significant contracts. Despite recognizing these issues, Travelers hasn’t agreed to compensate Zywave for any related losses. Per court records reviewed by Coverager, “Under the terms of the Policy, Travelers agreed to indemnify, reimburse and pay Zywave any and all Loss in excess of an applicable $500,000 Retention that Zywave reported to Travelers during the policy period of November 23, 2021 (the closing date under the ClarionDoor Acquisition Agreement) to November 24, 2024 (except for Extended Representations and the Pre-Closing Tax Indemnity for which the policy period extends to November 24, 2027), subject to a limit of liability of $10,000,000.” Zywave further states that “Had the Sellers disclosed the true state of ClarionDoor’s business, its Material Contracts and its Major Customers, Zywave would have walked away or paid far less to the Sellers.”

According to our sources, Zywave acquired ClarionDoor for an estimated $100 million in cash, with ClarionDoor’s annual revenue at the time hovering around $12 million. Additionally, about a year after the purchase, Zywave fulfilled an earn-out clause worth $50 million. This was subsequently followed by an exodus of key hires from ClarionDoor:

- Michael DeGusta, the former CEO of ClarionDoor, left the firm at the end of 2022 and is now working for Amwins.

- Rob Motaghedi, the former COO and founder of ClarionDoor, is no longer with the firm.

- Pat McCall, the former Chief Sales Officer at ClarionDoor, departed from the firm in March 2023.

- Clyde Owen, the former SVP of ClarionDoor, left the firm in September 2022 to join PCMI Corporation.

An anonymous Glassdoor review highlights the struggle to integrate recent acquisitions into a cohesive solution, despite expectations for a comprehensive product suite. Beyond the technological challenges, the transaction has also given rise to legal complications. In June 2023, FTP Inc. filed a lawsuit against ClarionDoor, alleging that the company failed to deliver a functional digital distribution software product, leading to losses from the nearly $200,000 investment. All in all, Zywave’s allegations against ClarionDoor raise questions about the timing of the issues they’ve encountered: Did these problems exist prior to the acquisition, or did they emerge post-sale, potentially affected by the conditions tied to fulfilling the earn-out clause? After all, timing is everything.

We reached out to Zywave for a comment.