Zurich North America launches Construction Weather Parametric Insurance

Zurich North America announced that it has launched Construction Weather Parametric Insurance for project owners and contractors – an offering that doesn’t require physical loss or damage for a claim to be paid.

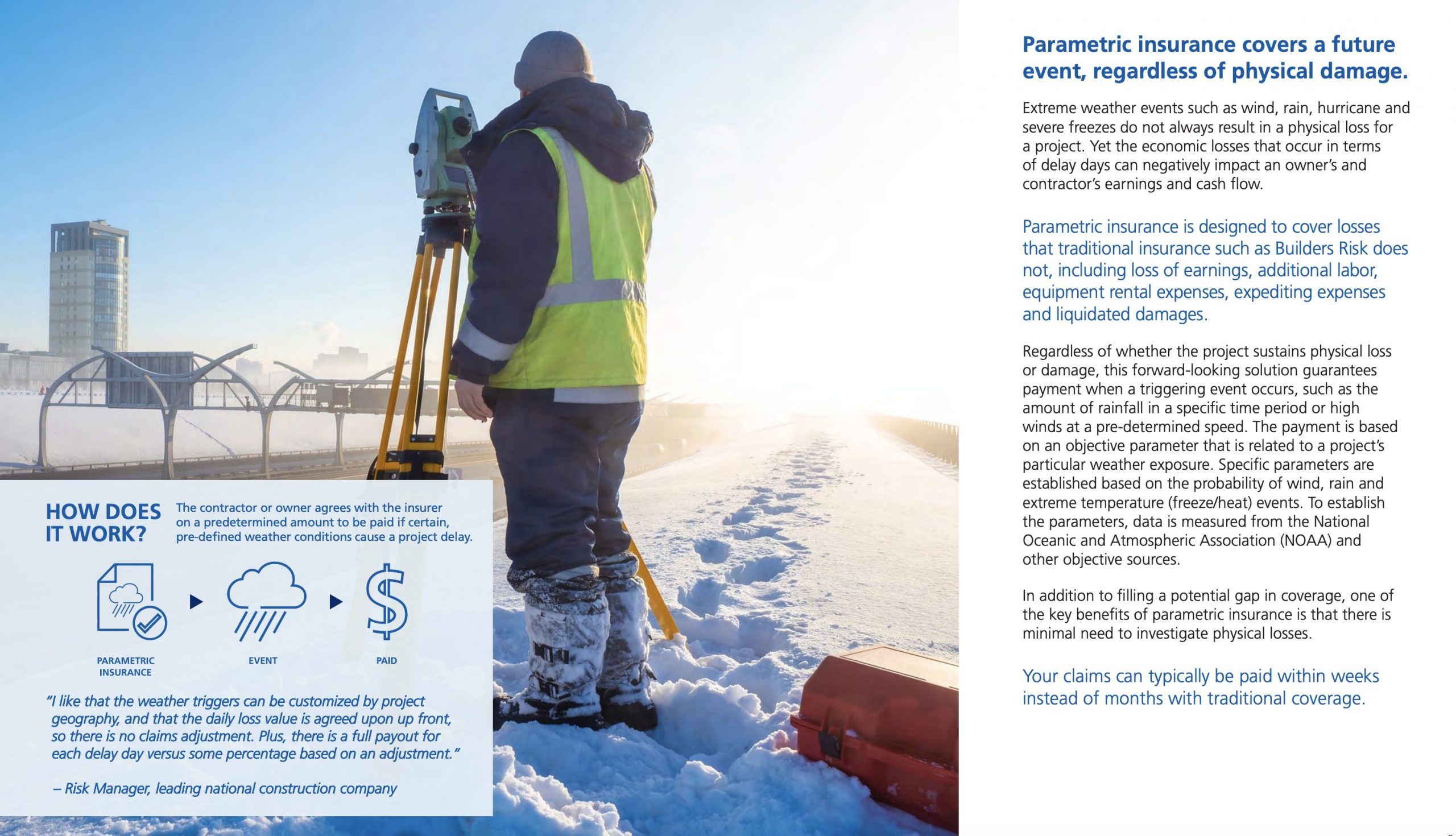

Instead, claim payment is based on predetermined weather events occurring in the project’s location, such as extreme rain, wind or temperatures (hot or cold). Any of these perils can cause project delays, resulting in severe financial losses, even when the project doesn’t sustain physical damage.

According to the company, the coverage is highly customizable for the buyer – contractor or owner – with options to help optimize cost-effectiveness for customers who face varying consequences if a project is delayed. An owner, for example, could incur heavy revenue losses from operating profits that aren’t being realized. A contractor who misses project deadlines could suffer penalties, including liquidated damages, as well as incur additional expenses.

“We are proud to offer this solution as a complement to our newly enhanced suite of Master Builders Risk and Project Builders Risk policy forms, which include flexible reporting options, as well as several new coverage enhancements attuned to today’s evolving marketplace. These innovative products demonstrate why Zurich has been a trusted leader in the construction space for 25 years. The Zurich Construction team is committed to putting our extensive knowledge, experience and financial strength to work for contractors and owners.” – Kelly Kinzer, Head of Construction Property for Zurich North America.

With Zurich Construction Weather Parametric Insurance, the perils, thresholds, limit, deductible and coverage duration can be individually tailored to meet the needs of the buyer. The threshold options for each peril are based on historical weather data at the location of the project. Parametric customers can purchase coverage for one or more weather perils, and coverage duration can be tailored to peak season for the weather risk and pegged to milestones in the construction schedule.

A simplified claims process helps expedite payouts. Because payment is based on objective weather data, there is little need to investigate the loss. Coverage responds as long as the trigger event occurs, the project is impacted within the agreed-upon dates, and the deductible has been met.