Built to Last

On January 2, we opened our first newsletter for the year with a ‘Briefed while’ regarding Farm Bureau. As a refresher, Farm Bureau Mutual Insurance Company of Idaho welcomed Todd Argall to its executive team late last year, and in an interview with Idaho State Business Journal, Todd mentioned that AM Best downgraded the insurer from an A to an A- because they are “financially strong but not as strong as we once were.”

Insurtechs are stronger more public than they once were

On June 28, 2018, EverQuote hit the public market completing its IPO at $18 per share, above an initial expected range of $15-$17. Xconomy reported on the story with the title “EverQuote, a Boston Tech Company You’ve Never Heard of, Raising $84M in IPO.” According to EverQuote CFO and Treasurer, John Wagner, EverQuote is “a data and tech-powered marketplace focused around insurance,” however, it defines “deep integration” as being able to pass at least 8 data fields that the consumer entered on their site to the carrier.

The company faces two challenges. It’s finding it difficult to diversify its auto insurance verticle which made up about 83% of its revenue this past quarter and a significant portion of its revenue is (still) derived from Progressive:

| 2016 | 2017 | 2018* | 2019 | 2020* | |

|---|---|---|---|---|---|

| % of Revenue from Progressive | 23 | 20 | 20 | 21 | 23 |

But, all in all, EverQuote is for everyone as it works with non-auto and auto insurers, established brands, and new entrants; including SelectQuote, Lemonade, and Root; these 3 are now part of the public market:

| Company | IPO Date | Current Mkt Cap ($B) |

|---|---|---|

| EverQuote | Jun 28, 2018 | 1.1 |

| SelectQuote | Mar 22, 2020 | 3.8 |

| Lemonade | Jul 1, 2020 | 5.8 |

| GoHealth | Jul 15, 2020 | 4.6 |

| Root | Oct 28, 2020 | 3.5 |

Looking at 2021, more insurance companies will enter the public markets and I’m thinking of Metromile, Hippo, Oscar and Bright Health. I’m thinking, not predicting.

A person is smart, people are dumb, the public market is unpredictable and on December 10 (last Thursday), Lemonade’s stock almost touched $100 per share; over 40 years after Berkshire’s stock jumped to $100 per share (remember, in 1976 “Geico was a very sick corporation“).

Insurers are aren’t buying it

Legacy insurers, on the other hand, are predictable and what we haven’t seen are show-off acquisitions involving an incumbent (carrier or broker) and a startup.

| Insurer Acquiring | Acquired | Date | Price |

|---|---|---|---|

| MassMutual | Flourish | 12/14/2020 | |

| Travelers | InsuraMatch | 12/04/2020 | |

| Boston Mutual | IT Operations of Onyx Data Solutions | 12/01/2020 | |

| Brown & Brown | CoverHound | 11/09/2020 | |

| Direct Line Group | Brolly | 07/16/2020 | |

| Aon | CoverWallet | 11/20/2019 | |

| Prudential Financial | Assurance IQ | 09/05/2019 | $2.4B |

| Legal & General | MyFutureNow | 08/16/2019 | |

| Zurich | Dentolo | 07/18/2019 | |

| Travelers | Zensurance | 08/15/2018 | |

| AXA | Maestro Health | 01/23/2018 | $155M |

| Travelers | Simply Business | 03/13/2017 | $490M |

When you think of it, the narrative is a lot more interesting in reverse – where new entrants are acquiring legacy carriers or traditional businesses.

| Acquiring | Acquired | Date |

|---|---|---|

| Bestow | Centurion Life Insurance Company | 12/01/2020 |

| Singlife | Aviva Singapore | 09/12/2020 |

| EverQuote | Crosspointe Insurance Advisors | 08/04/2020 |

| Buckle | American Service Insurance Company, American Country Insurance Company | 08/04/2020 |

| Buckle | Gateway Insurance Group | 06/17/2020 |

| Hippo | Spinnaker Insurance Company | 06/03/2020 |

The other untold narrative is that over half of noteworthy insurer-investors (defined as those that have participated in at least 4 rounds of investments in 2020) reduced their investment appetite in ‘insurtech’ in 2020 compared to last year. I know that 2020 is a weird year, to say the least, but that’s what we have to work with.

| Insurer-Investor | 2020 Investments | Insurance Appetite |

|---|---|---|

| 1. AXA (18) | DocAuthority, SendCloud, Troy, Medicare Mindoula Health, Unlatch, NS8, D-ID, Zenjob, HUB Security, Wellth, InsideBoard, K4Connect, Lessonly, Qloo, Cognism, Policygenius, Medloop, Phenom People | Decreased |

| 2. Desjardins Venture Capital (16) | POTLOC, Local Logic, Versaprofiles, Breathe Life, Umano Medical, Lateral Innovations, PreVu3D, HALEO Clinic, BrainBox AI, Lexop, WeCook, CareMedic System, Vosker, La Voie Maltée, Coop Agri-Énergie Warwick, WRK | Increased/Same |

| 3. MassMutual (14) | NYDIG, Turtlemint, Mine, Biofourmis, Ledger Investing, NeatX2, Payfone, RiskIQ, Qoala, Qure.ai, LinkSquares, Policygenius, Insurify | Increased/Same |

| 4. MS&AD (13) | Mind Foundry, CarroX2, BlackSwan Technologies, Bambi Dynamic, Hippo, Omise, CyGov, Skyflow, Dathena Science, Nimbla, Volocopter, Socotra | Increased/Same |

| 5. Northwestern Mutual (13) | Socialeads, Paceline, Trust & Will, FiveableX2, Mountain Health Technologies, OJO Labs, UNestX2, Splash Financial, Ladder Insurance, Gabi, PROMISS Diagnostics | Increased/Same |

| 6. American Family (11) | Turtlemint, Neat Capital, Wyze LabsX2, Tire Agent, Branch, Bold Penguin, Choosing Therapy, Reggora, Clearcover, Relay Platform | Decreased |

| 7. Munich Re (10) | At-Bay, Dayforward, Augury, Next Insurance, Acko, HDVI, Bought By Many, Sepio Systems, Homestead, At-Bay | Increased/Same |

| 8. Nationwide (9) | Indico, HOVER, Kinetic, Planck, Betterview, Nexar, Deep Sentinel, Insurify, Vesta Healthcare | Decreased |

| 9. Alma Mundi Ventures (8) | Galgus, Clarity AI, Submer, Cuideo, omocom, Agentero, Synthesized, BizAway | Decreased |

| 10. Aflac (7) | ACT Genomics, TCARE, Craif, Covr Financial Technologies, Mentalhealth Technologies, FamiOne, Tricog Health | Decreased |

| 11. Allianz (6) | Human API, Wealthsimple, BIMA, Amwell, Accern, Ladder Insurance | Decreased |

| 12. CUNA Mutual (6) | Coverance, Steady, Splash Financial, Jenny Life, MotoRefi, Gabi | Increased/Same |

| 13. Helvetia Venture Fund (6) | CobertooX2, Chargeryx2, Neon, Skribble | Increased/Same |

| 14. Societe Generale (6) | Axora, Horizonte Minerals, Northvolt, Abu Dhabi National Oil Company, eLamp, Mutumutu | Increased/Same |

| 15. Ping An (5) | Better.com, Lepu Bio, Taulia, PlusDental, iCapital Network | Decreased |

| 16. Intact Financial (5) | Lunewave, Gatik, Acko, Flinks, Algolux | Decreased |

| 17. MACSF (5) | Savana, Gleamer, Synapse Medicine, Owkin, Wellium | Increased/Same |

| 18. NFP Ventures (5) | Axio, Wellth, WealthTech, Vivante Health, Relay Platform | Decreased |

| 19. State Farm Ventures (5) | HOVER, Replicant, HOMEE, HopSkipDrive, Cape Analytics | Increased/Same |

| 20. Dai-ichi Life (4) | Photo electron Soul, Modulus Discovery, AIsing HIROTSU BIO SCIENCE | Decreased |

| 21. Liberty Mutual (4) | Jupiter Intelligence, HOMEE, SingularCover, Blueprint Title | Increased/Same |

| 22. CNP Assurances (4) | Moneybox, PayLead, CybelAngel, Lydia | Decreased |

| 23. UNIQA (4) | Doctorly, FinCompare, omni:us, Second Nature | Decreased |

Insurers are building relationships

What we’ve seen this year is insurance companies and startups show off their distribution strategies. Here’s how the story goes – first comes the product then comes the marriage (and sometimes it’s followed by divorce).

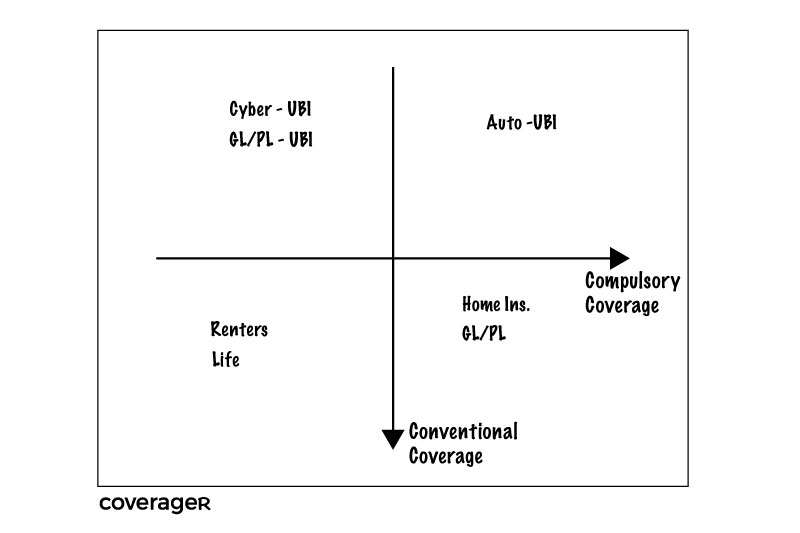

A. The product – which, at Coverager, we like to graph by 2 dimensions: compulsory and/or conventional – dictates whether the distribution ought to be intermediated, embedded, and/or direct-to-consumer.

B. The relationship – which in theory is built to last.

* * *

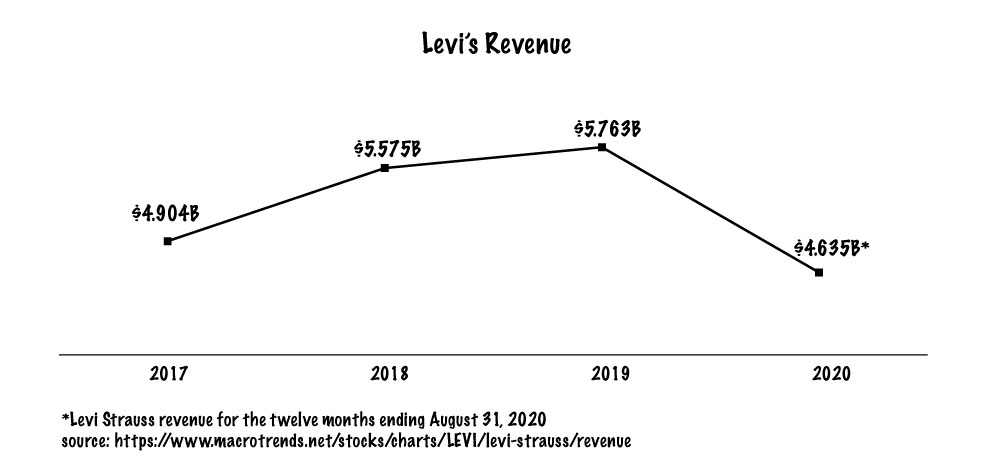

Levi’s is the brand that’s “Built to Last” that’s been losing to Lululemon before I ever spelled COVID-19. In the early 1990s, Levi’s supplied Walmart with jeans sold under the name Brittania but that came to an end in 1994 after Levi’s pulled its jeans from a Canadian chain of stores that were acquired by Walmart and sold Levi’s jeans. Back then Levi’s was concerned with diluting the brand but by 2003 a comeback strategy was in place which included upmarket and downmarket brands where Walmart got the Signature line (cheaper, basic brand) and other stores got the fashion-forward lines. And by 2015, the market share of Levi’s amounted to about 10.6% in the US. Walmart, on the other hand, came in second for its own jeans label with a 5% market share in the US.

The point is Levi’s has had an on and off and on-again relationship with Walmart because Walmart is worth it.

* * *

Looking beyond 2020, the door to the nation’s largest retailers, car manufacturers, fintechs, and media brands is wide open but you won’t all fit in and some of you don’t want to.

– Chubb has more than 150 distribution partnerships globally, and four partnerships announced in the last three years alone have given the company access to more than 60 million customers in Asia and Latin America.

– Fair.com divorced Assurant or the other way around (it doesn’t matter because it takes two to tango) as it stopped offering its embedded insurance coverage to customers of its vehicle subscription service, however, its founder knows a thing or two about developing a B2B2C strategy. In 2014, auto buying website Truecar (founded by Scott Painter who founded fair.com) has seen a third of its car buyers engage with its affinity network which included insurers such as AAA, GEICO and USAA.

– And then, of course, there’s Progressive, which passed GEICO by DPW earlier this year, and has partnered with Credit Karma to launch a usage-based insurance product based on how people drive. This is big (news) not because of what Progressive did but because of what Progressive didn’t do. It didn’t take its off the shelf auto insurance and gave it to Credit Karma. It created a fair proposition for a crowd that is likely price-sensitive and very different from the 49-year-old married male it hopes to attract for a bundled home and auto insurance product (its Robinsons segment). We’ve said this so many times and we’ll say it again – the internet is about selling insurance in a thousand different ways.

– Now, can you imagine Levi’s without Walmart? Advance Venture Partners, Gradient Ventures, Greenlight Re, Obvious Ventures, and PJC can. That’s essentially the statement these investors made by participating in Openly’s $40 million Series B round as Openly is sold exclusively through agents with an upmarket product that’s sold, not bought.

* * *