2022 Tech Survey Results: How Carriers and MGAs Address New Challenges

The insurance industry is undergoing massive transformation, fueled by rapidly changing customer expectations, and accelerated technological innovation. And while many carriers and MGAs see the need to keep up with innovation and meet these changing

expectations, information technology (IT) staff and resources have proved to be a challenge.

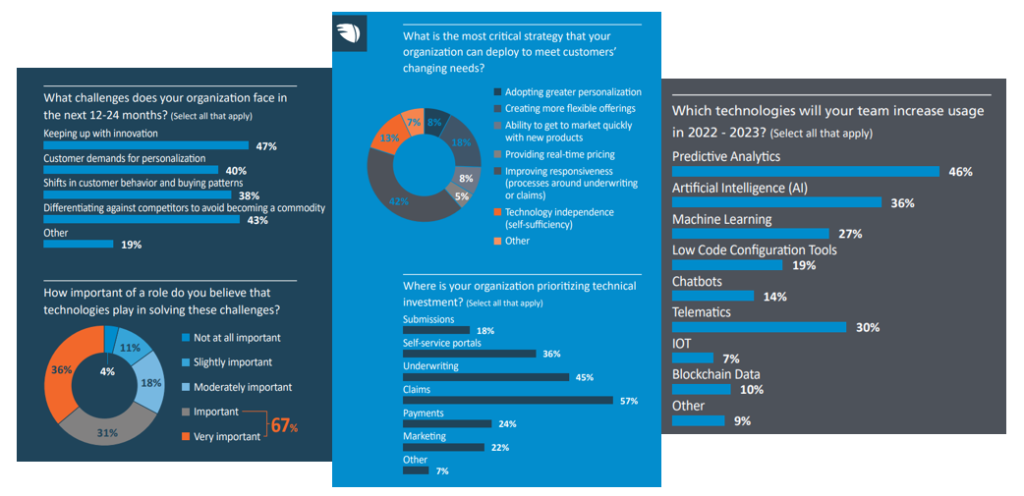

A new study, sponsored by OneShield, uncovered some of the most pressing concerns of the industry. The results of the survey below represent responses from P&C insurers (80%), MGAs (14%), and others (6%). Company size varied with 41% reporting 500 or fewer employees, 35% reporting between 501 and 5,000 employees, and 24% reporting 5,001 or more employees.

The results offer a benchmark for future study, as OneShield tracks the stages of transformation within the industry.

Keeping up with innovation is a major challenge

Study participants were asked to cite their greatest challenge over the next 12 to 24 months, and the most noted challenges were keeping up with innovation (47%) and finding ways to differentiate from competitors (43%). Many organizations struggle with

inflexible legacy systems that make it challenging to gain efficiency, stay competitive, and win customers and loyalty. Keeping up with innovation is made even more difficult when adopting a solution that becomes outdated far too quickly.

Other leading challenges included shifts in customer behavior and buying patterns (38%), and customer demands for personalization (40%), both difficult to address without the benefit of innovative data-enabled solutions. Over half of the participants (67%) say that

technologies such as data analytics and machine learning play an “important” or “very important” role in solving these challenges.

Most critical strategies for meeting customers’ changing needs

The OneShield survey found “improving claims and underwriting responsiveness,” the most critical strategy for meeting customers’ changing needs, identified by 42% of respondents. At the center of this strategy is the goal to offer a superior customer experience, and to do so efficiently and cost-effectively. Customers want faster and more responsive experiences, and insurers succeed by enabling technology to deliver more personalized services and offerings in real-time.

Prioritizing future technology investments

Insurers are deciding how best to use their resources to better serve policyholders, and over half (57%) of the OneShield survey respondents report plans to invest in claims related technologies. Further, 45% of survey participants are prioritizing underwriting

investments. These support the desire to improve responsiveness in these areas. A major challenge to these initiatives, “limited IT resources and staff,” was cited as the top barrier to moving forward (59%). Technology and infrastructure concerns were the second

most common barrier (32%). These two challenges, hand in hand, are the greatest hurdles to insurers maintaining complex legacy systems. Maintenance and modifications to the architecture are both costly and limited, compared to the flexibility of the modern core system platform.

Respondents value data-driven initiatives and top tools foreseen to support team efforts over the next two years include predictive analytics (46%), machine learning (27%), and telematics (30%). It’s evident that insurers see innovation and technology as the key to moving toward a customer-centered model – throughout the policy life cycle. To stand apart from others with unique value adds and coverages, insurers succeed with easily configurable tools that enable swift changes to meet market demands.

It’s also clear that infrastructure, IT staffing, and resources are significant challenges in implementing many strategic initiatives. Insurers addressing legacy system limitations, require the right solution partner to meet both IT staffing and infrastructure challenges.

The selection of a modern core system includes not only the architecture that will enable today’s innovations but those of our future innovators – and provides you with options for implementation and ongoing support at whatever level you require.

As 2022 comes to a close, what’s ahead for the insurance industry? We’d like your perspective on what will drive innovation in 2023. Please take our new survey, and join your peers in sharing predictions, opportunities, and challenges for the industry ahead. Aggregated survey results are available at the completion of the survey, and we’ll report the final results here on Coverager in 2023.

This article is an excerpt from the full report, IT and the race for talent: How insurers and MGAs can adapt, released in September of 2022. Visit us at OneShield.com. We’re in the business of creating limitless potential for MGAs and P&C insurers.